Pike Robert, Neal Bill. Corporate finance and investment: decisions and strategy

Подождите немного. Документ загружается.

.

Chapter 19 Does capital structure really matter? 515

Table 19.1

Key definitions in

capital structure

analysis

overall market value of the whole company

value of the shareholders’ stake in the company

market value of the company’s outstanding borrowings

book value of borrowings (generally assumed equal to its market value)

rate of return required by shareholders

rate of return required by providers of debt capital

overall (weighted average) cost of capital

coupon rate on debt

interest charges (i.e. payments to lenders, based on book value)

so that

net operating income

It should be stressed that we are assuming no retention of earnings, i.e.

and hence no growth, and, for the moment, no taxes on corporate

profits.

The value of equity in an all-equity firm is:

The value of a geared firm making interest payments of iB is:

The value of the whole firm in either case is:

V

o

V

S

V

B

V

S

1E iB2

k

e

V

S

D

k

e

E

k

e

D1dividends2 E,

1NOI2 1iB k

e

V

S

2 annualE

payments to shareholders 1E iB2,k

e

V

S

annualiB

thei

thek

o

thek

d

thek

e

theB

theV

B

theV

S

theV

o

■ MM’s assumptions

The MM thesis did not go unchallenged. Much criticism of MM’s analysis stemmed from

failure to understand positive scientific methodology. Their analysis attempted to isolate

the critical variables affecting firm value under the restrictive conditions of a perfect capi-

tal market. This provided a systematic basis for examining how imperfections in real

world markets could influence the links between value and risk. The key assumptions are:

■ All investors are price-takers, i.e. no individual can influence market prices by the

scale of his or her transactions.

■ All market participants, firms and investors, can lend or borrow at the same risk-

free rate.

■ There are neither personal nor corporate income taxes.

■ There are no brokerage or other transactions charges.

■ Investors are all rational wealth-seekers.

■ Firms can be grouped into ‘homogeneous risk classes’, such that the market seeks

the same return from all member firms in each group.

■ Investors formulate similar expectations about future company earnings. These are

described by a normal probability distribution.

■ The assets of an insolvent firm can be sold at full market values.

19.3 MM’S PROPOSITIONS

MM’s analysis was presented as three propositions, the first being the crucial one.

■ Proposition I

The central proposition is that a firm’s WACC is independent of its debt/equity ratio, and

equal to the cost of capital that the firm would have with no gearing in its capital structure.

CFAI_C19.QXD 10/26/05 5:22 PM Page 515

.

516 Part V Strategic financial decisions

In other words, the appropriate capitalisation rate for a firm is the rate applied by the

market to an ungeared company in the relevant risk category, i.e. that company’s cost

of equity. The arbitrage mechanism will operate to equalise the values of any two com-

panies whose values are temporarily out of line with each other. The example of

Nogear plc and Higear plc will illustrate this.

Nogear plc and Higear plc

Nogear plc is ungeared, financed by 5 million shares, while Higear plc’s Balance

Sheet shows million debt, interest payable at 10 per cent, and 4 million shares.

Higear’s debt/equity ratio is thus per cent, at book values. The two

firms are identical in every other respect, including their business risks and levels of

annual expected earnings (E) of million. The market requires a return of 20 per cent

for ungeared streams of equity income of this risk.

Imagine that, temporarily, the market value of Nogear is million and that of Higear

is million. Higear’s equity is thus valued by the market at (Its

debt/equity ratio expressed in terms of market values is thus per cent.)

These market values correspond to respective share prices of

for Nogear and for Higear.

The different share values conform to the traditional relationship at relatively low

gearing ratios. Higear has a greater value presumably due to its gearing. Also, it

appears that Nogear is undervalued by the market since, at a required return of 20

per cent, its value should be

MM argue that such imbalances can only be temporary and the benefit obtained by

Higear for its shareholders is largely illusory. It will pay investors to sell their holdings in

the overvalued company and buy stakes in the undervalued one. Specifically, sharehold-

ers can achieve a higher return by selling holdings in Higear, and simultaneously, repli-

cate its gearing (MM call this ’home-made gearing’) and achieve a higher overall return.

This process of arbitrage will force up the value of Higear and lower Nogear’s value, until

their values are equalised. There is thus little point in a firm borrowing to gear-up its cap-

ital structure when investors can achieve the same benefits by acting independently.

Home-made gearing

Consider the case of an investor with a 1 per cent equity stake in Higear. At present, this

stake is worth attracting an income of 1 per cent of

( million less interest payments of ), i.e. This

investor could realise his or her holdings for and duplicate Higear’s debt/equity

ratio of 20 per cent by borrowing at 10 per cent and investing the total stake of

in Nogear shares. This would buy of Nogear’s equity, to

yield a dividend of Personal interest commitments amount

to for a net return of

£14,000. Clearly, it would pay all investors to undertake this arbitrage exercise, thus

pushing down the value of Higear and pushing up the value of Nogear until there was

no further scope to exploit such gains. This point would be reached when the market val-

ues of the two companies were equal and when each offered the appropriate 20 per cent

return required by the market:

At this equilibrium relationship, the price of each company’s shares is For

Nogear, the calculation is while for Higear, the relevant fig-

ures are divided by In an MM world, there are no

prolonged benefits from gearing, and any short-term discrepancies between geared and other-

wise identical ungeared companies quickly evaporate. As a result, MM concluded that both

company value and the overall required return, are independent of capital structure.k

o

,

4 m shares £1.1£5 m £1 m debt2

1£5 m>5 m shares2 £1,

£1.

Value of Nogear Value of Higear

E

k

e

£1 m

0.2

£5 m

1£15,000 £1,0002110% borrowings of £10,0002 £1,000,

11.5% £1 m2 £15,000.

1£60,000>£4 m2 1.5%£60,000

£10,000

£50,000

11% £900,0002 £9,000.10% £1 m£1

11 per cent of £5 m2 £50,000,

1£1 m>0.22 £5 m.

1£5 m>4 m shares2 £1.25

1£4 m>5 m shares2 80p

£1 m>£5 m 20

1£6 m £1 m2 £5 m.£6

£4

£1

1£1 m>£4 m2 25

£1£1

£1

’home-made gearing’

Where an investor borrows to

arbitrage between two identi-

cal but differently-valued

assets

CFAI_C19.QXD 10/26/05 5:22 PM Page 516

.

Chapter 19 Does capital structure really matter? 517

In reality, not all of the conditions required to support the arbitrage process may

apply, suggesting that any observed benefits may derive from imperfections in the cap-

ital market. Moreover, if gearing does result in higher company value, there must have

been a wealth transfer, since nothing has occurred to alter the fundamental wealth-

creating properties of the company.

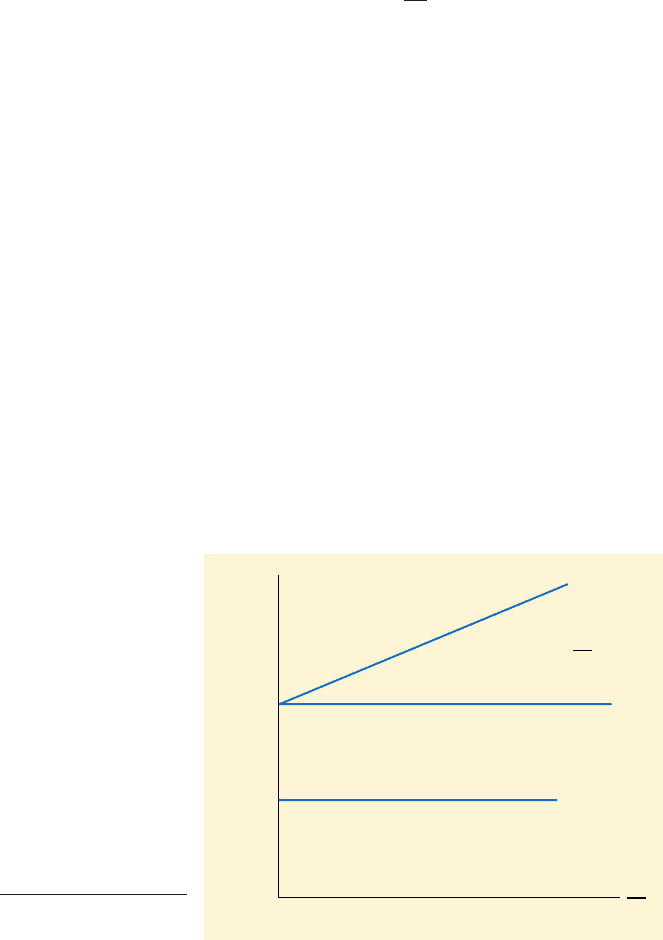

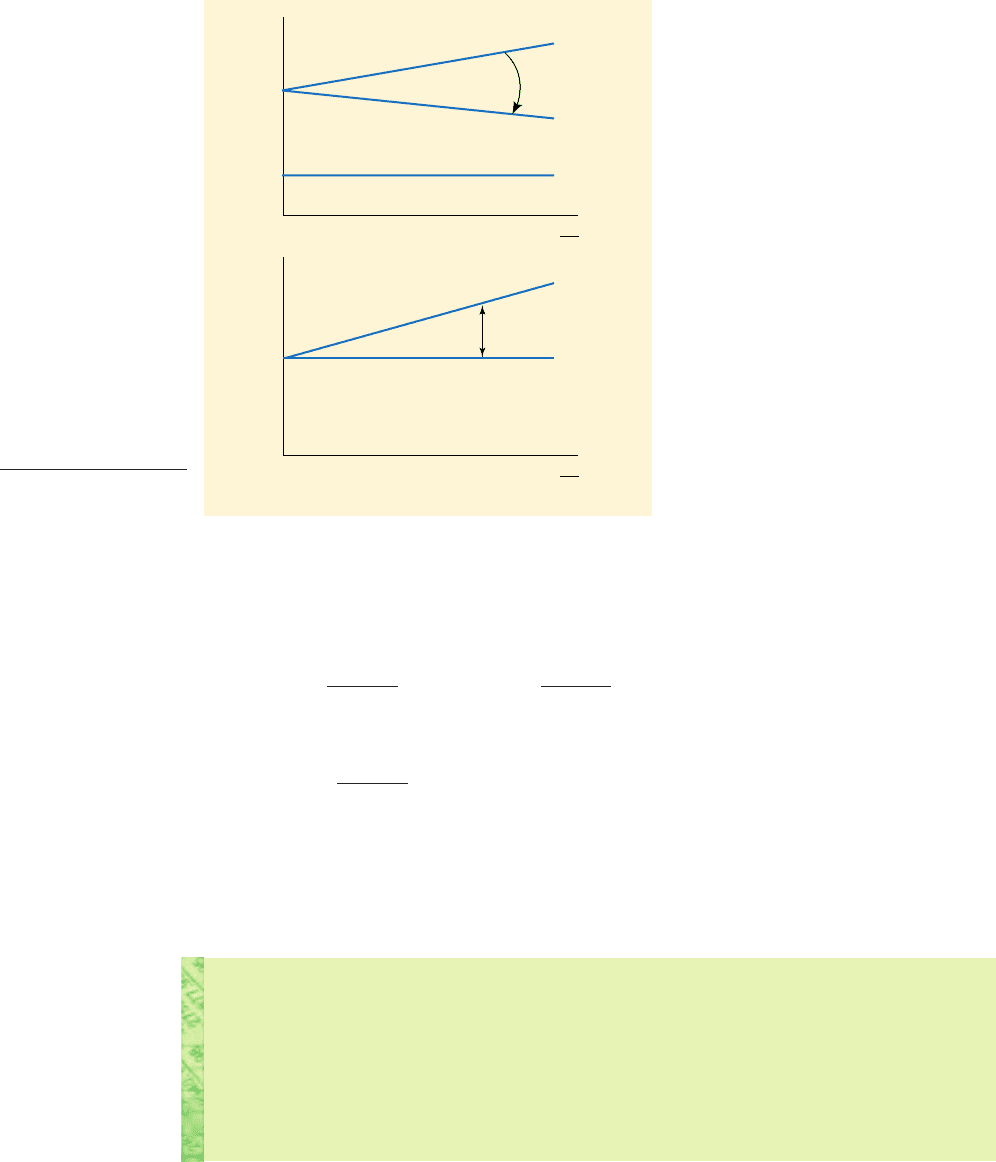

■ Proposition II: the behaviour of the cost of equity

Underpinning Proposition I is a statement about the behaviour of the relevant cost of

capital concepts – in particular, the rate of return required by shareholders. This is

expressed in MM’s second proposition which states ‘the expected yield of a share of equity

is equal to the appropriate capitalisation rate, for a pure equity stream in the class, plus a pre-

mium related to the financial risk equal to the debt/equity ratio times the spread between and

This proposition can be expressed as:

where and denote the returns required by the shareholders of a geared company

and an equivalent ungeared company, respectively. The expression is easily obtained

from Proposition I. (See Appendix I to this chapters). It simply tells us that the rate of

return required by shareholders increases linearly as the debt/equity ratio is increased, i.e. the

cost of equity rises exactly in line with any increase in gearing to offset precisely any

benefits conferred by the use of apparently cheap debt. The relevant relationships are

shown in Figure 19.1.

If you check back to Chapter 18, which covered the traditional view of gearing, and

to Figure 18.2 in particular, you will find that the behaviour of is the critical differ-

ence between the MM version and the traditional. In the latter, there is little or no reac-

tion by shareholders to an increase in debt-to-equity ratio over ‘modest’ levels of

gearing. They presumably are not alarmed by the ‘judicious’ use of debt. By contrast,

shareholders, in the MM view, respond immediately when any gearing is undertaken,

i.e. to them, any use of debt introduces an element of risk.

It should now be appreciated that in the Nogear/Higear example, Higear share-

holders were seeking too low a rate of return, i.e. Higear was overvalued, and the mar-

ket was temporarily offering Nogear’s shareholders too high a return, i.e. Nogear was

undervalued. Via the process of arbitrage, their values were brought back into line,

k

e

k

eu

k

eg

k

eg

k

eu

1k

eu

k

d

2

V

B

V

S

k

d

¿.

k

e

k

e

,

Required return

k

eu

0

V

B

V

S

V

B

V

S

i

=

k

d

k

o

k

eg

k

eg

=

k

eu

+ (

k

eu

–

k

d

)

Figure 19.1

MM’s Propositions I

and II

CFAI_C19.QXD 10/26/05 5:22 PM Page 517

.

518 Part V Strategic financial decisions

and appropriate rates of return on equity were established, reflecting their respective

levels of gearing. The correct rate of return for Higear’s equity, for its particular

debt/equity ratio of 25 per cent (at equilibrium market values) is:

■ Proposition III: the cut-off rate for new investment

MM’s third proposition asserts that ‘the cut-off rate for new investment will in all cases be

and will be unaffected by the type of security used to finance the investment’.

A proof of this proposition is given in Appendix II to this chapter, but it is quite easy

to justify intuitively. Proposition I states that the WACC, is constant and equal to the

cost of equity in an equivalent ungeared company. Since is invariant to capital struc-

ture, it follows that however a project is financed, it must yield a return of at least

the overall minimum return required to satisfy stakeholders as a whole.

It is worth illustrating this contention for the case where a company invests to yield

a return above the cost of the debt used to finance the project, but below the cost of equity

in an ungeared company.

Nogear: right and wrong investment cut-off rates

Nogear decides to raise million via a debt issue at 10 per cent to finance a new proj-

ect expected to yield an annual return of 15 per cent for many years into the future. Is

this an acceptable project? Proposition I tells us that the initial value of the company,

and hence the equity, prior to the issue is:

Incorporating the new project’s earnings, the post-issue value of the whole company,

is:

Denoting R as the return on the new investment, I, and as the value of the debt

issued, the new value of the equity, is:

The value of the equity falls because the new project’s return, although above the

interest rate on the debt used to finance it, is less than the capitalisation rate applica-

ble to companies in this risk category.

£4.50 m

V

S1

V

o

RI

k

o

V

Bo

I £5 m

£0.30 m

0.2

0 £2 m 1£6.50 m £2 m2

V

S1

,

V

B

V

1

£1 m 115% £2 m2

20%

£1.30 m

0.2

£6.50 m

V

1

,

V

o

V

So

E

k

e

£1 m

0.2

£5 m

V

So

,

V

o

,

£2

k

o

,

k

o

k

o

,

k

o

k

eg

k

eu

1k

eu

k

d

2

V

B

V

S

20% 120% 10%2

£1 m

£4 m

22.5%

Self-assessment activity 19.1

Why does a geared company have the same value (allowing for size) as an ungeared com-

pany of equivalent risk in the ‘basic’ MM model?

(Answer in Appendix A at the back of the book)

CFAI_C19.QXD 10/26/05 5:22 PM Page 518

.

Chapter 19 Does capital structure really matter? 519

The operation of the arbitrage process requires that corporate and personal gearing are

perfect substitutes in a perfect capital market. The Nogear/Higear example showed

how individual investors could replicate corporate gearing to unwind any transitory

premium in the share price of a geared company. Much criticism of MM centres on the

perfect capital market assumptions and hence the extent to which the arbitrage process

can be expected to operate in practice.

In reality, brokerage fees discriminate against small investors, and other transaction

costs limit the gains from arbitrage. Moreover, if companies can borrow at lower rates

than individuals, investors may prefer the equity of geared companies as vehicles for

obtaining benefits otherwise denied to them. It is well known that, for reasons of size,

security and convenience, large firms can borrow at lower rates than small firms and

individuals. In addition, some major UK investors (e.g. pension funds) face restric-

tions on their borrowing powers, limiting their scope for home-made gearing. Finally,

whereas the shareholders in a geared firm have the protection of limited liability, per-

sonal borrowers enjoy no such protection in the event of bankruptcy.

Some authors suggest that such imperfections may foster investor demand for the

equity of geared companies. However, to sustain this argument, we would need to

produce evidence that relatively (but safely) geared companies are more attractively

rated by the market. There is little evidence that such firms sell at relatively high P:E

ratios. Indeed, UK investment trust companies, which invest in equities, often using

substantial borrowed capital, typically sell at significant discounts to their net asset

values – discounts far higher than can be plausibly explained by the transactions costs

that would be incurred in liquidating their portfolios.

19.5 MM WITH CORPORATE INCOME TAX

The analysis of MM’s three propositions in Section 19.3 is a theoretical exercise, designed

to isolate the key variables relating company value and gearing. This only becomes oper-

ational when ‘real-world’ complications are introduced. Perhaps the most important of

these is corporate taxation. In most economies, corporate interest charges are tax-

allowable, providing an incentive for companies to gear their capital structures. In a

taxed world, the MM conclusions change significantly.

Because Corporation Tax is applied to earnings after deducting interest charges, the

value of a geared company’s shares is the capitalised value of the after-tax earnings

stream (net income), i.e.

where is the return required by shareholders, allowing for financial risk, and T is

the rate of tax on corporate profits.

Assuming that the book and market values of debt capital coincide so that

the cost of debt, equates to the coupon rate, i, the value of debt is the discounted

interest stream, i.e. The value of the whole company is thus:

V

o

V

S

V

B

1E iB211 T2

k

eg

iB

i

V

B

iB>i.

k

d

,

1B V

B

2,

k

eg

V

S

1E iB211 T2

k

eg

1E iB211 T2:

Self-assessment activity 19.2

What factors restrict the ability of investors to arbitrage in the way envisaged by MM?

(Answer in Appendix A at the back of the book)

19.4 DOES IT WORK? IMPEDIMENTS TO ARBITRAGE

CFAI_C19.QXD 10/26/05 5:22 PM Page 519

.

This is a highly significant result. The expression for the value of the geared com-

pany comprises the value of an equivalent ungeared company, plus a premium

derived by discounting to perpetuity the stream of tax savings that can be claimed so

long as the company has sufficient taxable capacity, i.e. if The introduction of

this second term, TB, the discounted value of future tax savings, or the tax shield, is a

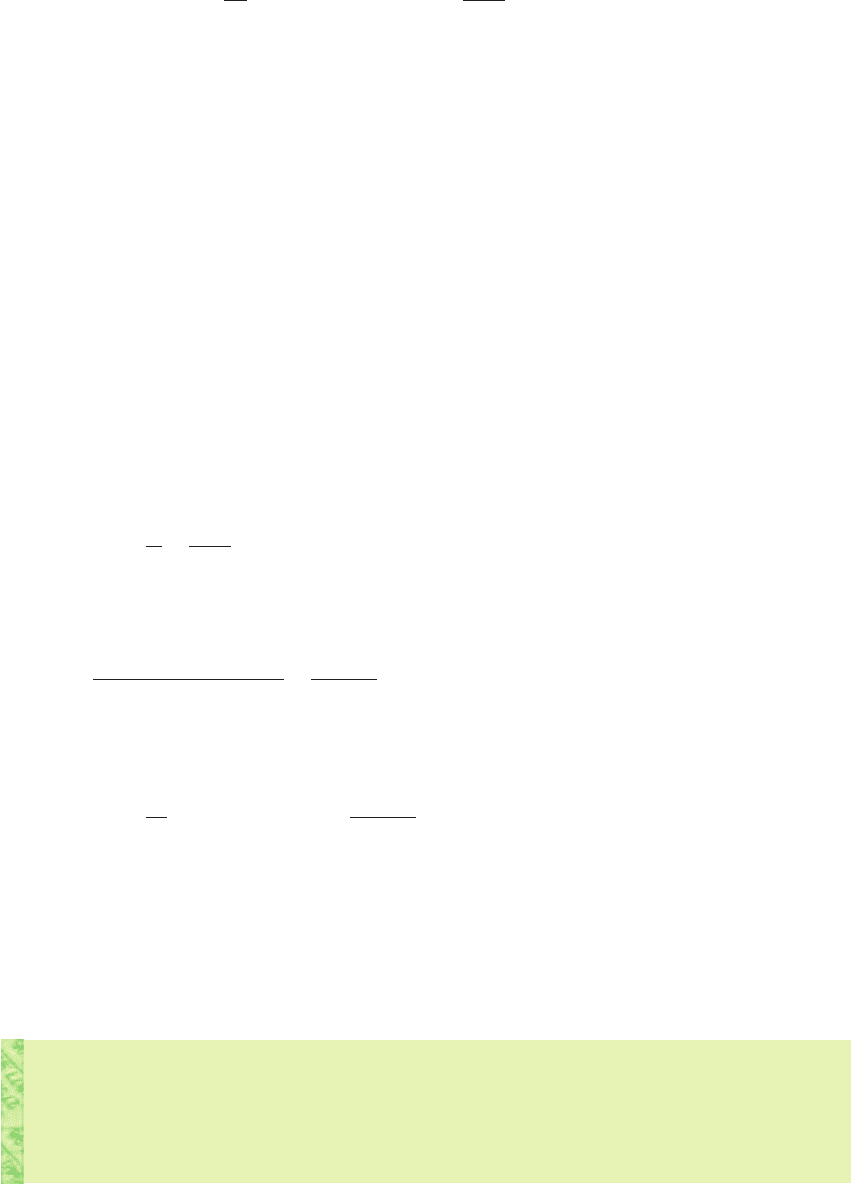

major modification of MM’s Proposition I, as shown in Figure 19.2.

The company value profile now rises continuously with gearing. Proposition II also

needs modification. With no corporate tax, this stated that the shareholders in a geared

company require a return, of:

However, in a taxed world, the return required by shareholders becomes:

The return required by the geared company’s shareholders is now the cost of equity

in an identical ungeared company plus a financial risk premium related to the corpo-

rate tax rate and the debt/equity ratio.

The premium for financial risk required by shareholders is lower in this version owing

to the tax deductibility of debt interest, making the debt interest burden less onerous. This

relationship is also shown by Figure 19.2. It follows that if, at every level of gearing, the

cost of equity is lower and also the cost of debt itself is reduced by interest deductibility,

k

eg

k

eu

1k

eu

i211 T2

V

B

V

S

k

eg

k

eu

1k

eu

k

id

2

V

B

V

S

k

eg

,

E 7 iB.

V

u

,

520 Part V Strategic financial decisions

It can be shown that geared companies will sell at a premium over equivalent

ungeared companies because of the benefits of tax-allowable debt interest. The post-

tax annual expected earnings stream, comprises the earnings attributable to share-

holders plus the debt interest:

This simplifies to:

This second expression is very useful: the first element is the net income that the

shareholders in an equivalent ungeared company would receive, while the second

element is the annual tax benefit afforded by debt interest relief. The total value of the

geared company, is found by capitalising the first element at the cost of equity cap-

ital applicable to an ungeared company while the second is capitalised at the cost

of debt, which we have assumed equals the nominal rate of interest, i:

V

g

E11 T2

k

eu

TiB

i

E11 T2

k

eu

TB V

u

TB

1k

eu

2,

V

g

,

E

T

E11 T2 TiB

E

T

1E iB211 T2 iB

E

T

,

tax shield

The tax savings achieved by

setting tax-allowable expenses

such as interest payments

against profits

Self-assessment activity 19.3

What are the respective values of geared and ungeared firms if:

■ Earnings £100 m before tax

■ Tax rate 30%

■

■

The geared firm borrows

£200 m?

(Answer in Appendix A at the back of the book)

k

eu

15%

CFAI_C19.QXD 10/26/05 5:22 PM Page 520

.

Chapter 19 Does capital structure really matter? 521

the WACC is lower at all gearing ratios, and declines as gearing increases. Figure 19.2

shows the resultant pivoting in the profile.

The tax advantage of debt financing is incorporated in the revised equation for the

WACC:

This can also be written as:

Clearly, there are significant advantages from gearing, with the implication that

companies should gear up until debt provides almost 100 per cent of its financing.

However, this does not seem plausible. Surely there are practical, ‘sensible’ limits to

company gearing, given the risks involved? More of this later!

k

o

k

eu

c1

T V

B

V

S

V

B

d

k

o

ck

eg

V

S

V

S

V

B

d ci11 T2

V

S

V

S

V

B

d

k

o

1k

o

2

Self-assessment activity 19.4

Compare the overall required return in geared and ungeared firms if:

■

■

■

The geared firm has borrowed

£200 m

at 7% interest, and has issued equity of £400 m.

(Answer in Appendix A at the back of the book)

Tax rate 30%

k

eu

15%

k

eg

k

eu

k

o

k

d

=

i

(1 – T)

0

V

B

V

S

Cost of capital

V

u

0

V

B

V

S

Company value

V

g

=

V

u

+

TB

TB

V

u

Figure 19.2

The MM thesis with

corporate income tax

■ Example of the impact of corporate taxation

It is now helpful to demonstrate ‘with-tax’ relationships using the examples of Nogear

and Higear. Recall that both companies had E of million and their equilibrium mar-

ket values were million under the ‘no-tax’ version of the MM thesis. After taxation,£5

£1

CFAI_C19.QXD 10/26/05 5:22 PM Page 521

.

522 Part V Strategic financial decisions

shareholder earnings in Nogear fall to With 30 per cent Corporate Tax, net

income is Capitalised at 20 per cent, the value of the

ungeared company is:

In the case of Higear, net income for shareholders is given by taxable earnings of

less the tax charge of to yield net income of:

This might be capitalised at the geared cost of equity and added to the value of debt

to yield the overall company value. However, there is a circular problem here, since

the calculation of the market value of the shares, derives from the calculation of

which itself depends on A remedy for this problem is to use the expression

encountered above. This yields:

It is useful also to cross-check on the components of and the return required by

Higear’s shareholders. If and the value of debt is million, the value

of Higear’s equity must be Using the revised expression

for the return required by the shareholders of a geared company, we find:

The geared company clearly has a greater market value – it is worth more due to

the value of the tax shield. The size of this tax shield depends on the gearing ratio, the

rate of taxation and the taxable capacity of the enterprise. Since gearing has raised

company value, the earlier conclusion, that the benefits of gearing are illusory, must be

modified. The reason is that the stakeholders of Higear benefit at the expense of the

taxpayer due to the tax deductibility of debt interest. (Whether this is desirable or not

in a wider context depends on the value of the forgone tax revenues in their alterna-

tive use, which is an issue for welfare economists.)

In its tax-adjusted form, the MM thesis looks rather more like the traditional version,

in so far as the WACC declines over some range of gearing. However, the benefits from

gearing clearly derive from the tax system, rather than from the apparent failure of the

shareholders to respond fully to financial risk by seeking higher returns. We will discov-

er that the similarity becomes even closer when we allow for financial distress. Before

doing this, we will show how the MM approach can be integrated with the CAPM.

120% 2.5%2 22.5%

20% 120% 10% 211 30%2

£1 m

£2.8 m

k

eg

k

eu

1k

eu

i211 T2

V

B

V

S

1£3.80 m £1 m2 £2.80 m.

£1V

g

£3.80 m,

V

g

V

g

V

u

TB £3.50 m 130% £1 m2 1£3.50 m £0.30 m2 £3.80 m

V

g

V

u

TB

V

S

.

k

eg

,V

S

,

1£0.9 m 0.72 £0.63 m

NI 1E iB211 T2 3£1 m 110% £1 m2411 30% 2

T1E iB21E iB2

V

u

£1 m11 30% 2

k

eu

£0.70 m

0.2

£3.50 m

£1 m11 30% 2 £0.70 m.

£1 m11 T2.

19.6 CAPITAL STRUCTURE THEORY AND THE CAPM

A feature of MM’s initial model was the classification of firms into ‘homogeneous risk

classes’ as a way of controlling for inherent operating or business risk. The modern dis-

tinction between systematic and specific risk makes this device unnecessary, as relevant

business risk is expressed by the Beta. The key point is that gearing introduces addi-

tional risk so that shareholders require additional compensation. Whereas in an ungeared

firm the cost of equity is

k

eu

R

f

b

u

1ER

m

R

f

2,

CFAI_C19.QXD 10/26/05 5:22 PM Page 522

.

Chapter 19 Does capital structure really matter? 523

in a geared firm this becomes

with

and

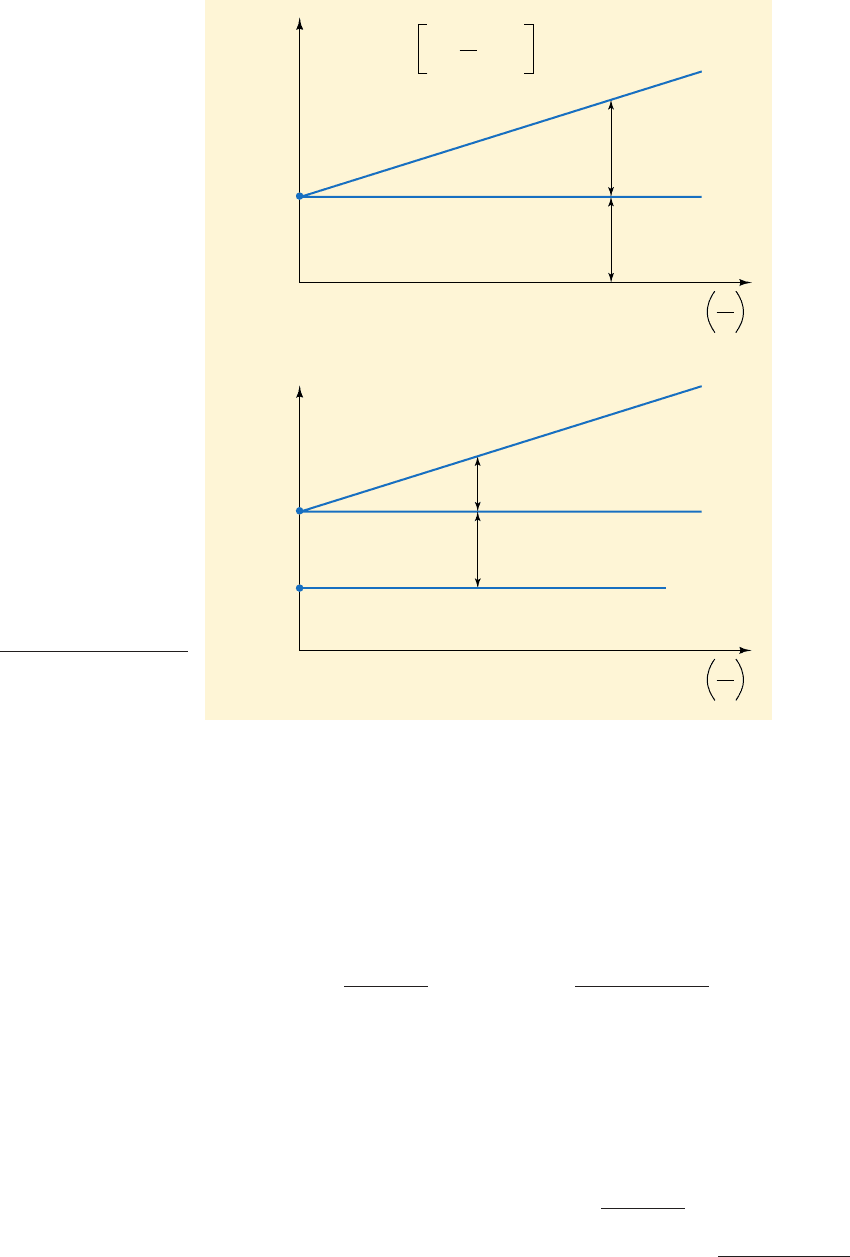

Clearly, gearing increases the equity Beta. It is a relatively simple task to integrate

the MM analysis with the CAPM. This was first performed by Hamada (1969), who

demonstrated that the required return on the equity of a geared firm in a CAPM

framework is:

where is the Beta applicable to the earnings of an ungeared company, or the pure

equity Beta. Multiplying out, we derive:

This looks unwieldy, but is a useful vehicle for making the distinction between

business and financial risk. The Betas recorded by the London Business School, are

geared equity Betas, incorporating elements of both types of risk. Given that and using

Hamada’s revised CAPM expression, the geared Beta, , is:

The ungeared equity Beta is therefore:

This can also be written as:

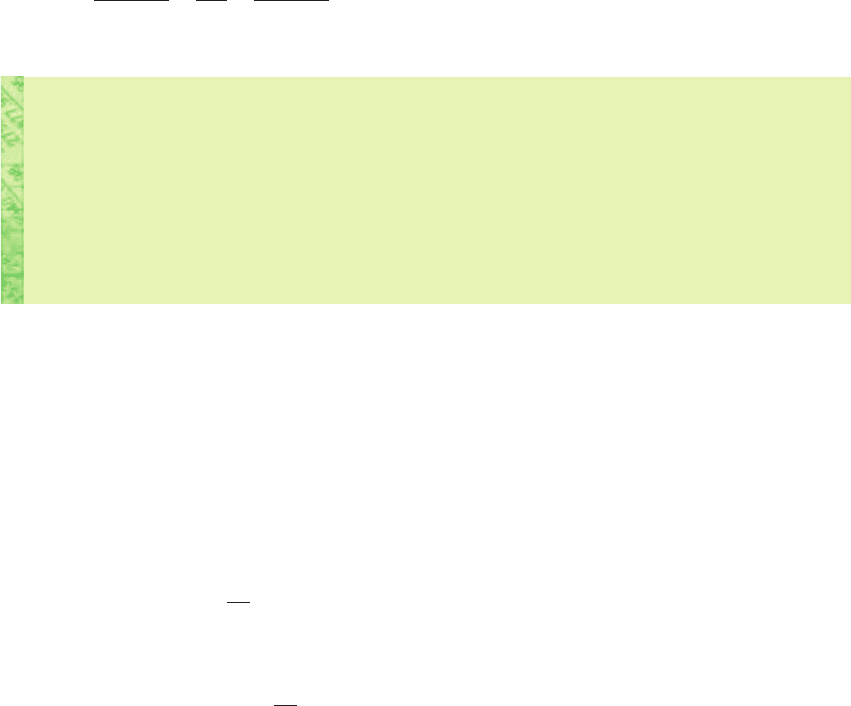

The shareholders of a geared company seek compensation for two separate types

of risk – the underlying or basic risk of the business activity, and also for financial

risk. The rewards for bearing these two forms of risk are the respective premiums for

business risk and for gearing.

■ Higear and Nogear: separating the risk premiums

To explore this distinction, consider again the example of Nogear and Higear. Assume

that the ungeared Beta applicable to this risk class is 1.11, the risk-free return is 10 per

cent, the return expected on the market portfolio is 19 per cent and the corporate tax

rate is 30 per cent. Recall that when we last encountered these companies (see Section

19.5) their respective values were:

V

S

1£3.80 m £1 m2 £2.80 m

V

B

£1 m

Higear: V

g

V

u

TB 1£3.50 m £0.30 m2 £3.80 m

Nogear: V

u

V

S

£3.50

b

u

b

g

c

V

S

V

S

V

B

11 T2

d

b

u

b

g

c1

V

B

11 T2

V

S

d

b

g

b

u

c1

V

B

11 T2

V

S

d

k

eg

R

f

b

g

1ER

m

R

f

2

b

g

k

eg

R

f

b

u

1ER

n

R

f

2 1ER

m

R

f

2 b

u

c

V

B

11 T2

V

S

d

b

u

k

eg

R

f

1ER

m

R

f

2 b

u

c1

V

B

11 T2

V

S

d

k

eu

7 k

e

.

b

g

7 b

u

k

eg

R

f

b

g

1ER

m

R

f

2

CFAI_C19.QXD 10/26/05 5:22 PM Page 523

.

524 Part V Strategic financial decisions

First, we can verify the return required by Nogear’s shareholders. This is:

Second, we can analyse the composition of the return required by Higear’s share-

holders. To find the overall return they seek, we need to know the geared Beta. This is

given by:

For the return required by Higear’s shareholders is:

Analysing the cost of equity for Higear into its components, we find:

110% 10% 2.5% 2 22.5%

10% 1.11 319% 10% 4 319% 10% 4 1.11

£1 m11 30% 2

£2.80 m

R

f

b

u

3ER

m

R

f

4 3ER

m

R

f

4b

u

V

B

11 T2

V

S

k

eg

Risk-free rate Business risk premium Financial risk premium

110% 12.5%2 22.5%

k

eg

R

f

b

g

3ER

m

R

f

4 10% 1.3875 319% 10% 4

b

g

1.3875,

b

g

b

u

c1

V

B

11 T2

V

S

d 1.11 c1

£1 m

11 30% 2

£2.80 m

d 1.3875

10% 1.11319% 10% 4 110% 10% 2 20%

k

eu

R

f

b

u

3ER

m

R

f

4

Beta

b

u

b

g

b

u

Impact of financial

risk

Impact of activity,

or business risk

V

B

V

S

V

B

V

S

Gearing

0

b

g

= b

u

1 + (1−T)

Required

return

b

u

R

f

k

eg

k

eu

Premium for

financial risk

Required return

on equity in a

geared firm

Premium for

business risk

Risk-free rate

Ungeared firm

cost of equity

V

B

V

S

Gearing

0

Figure 19.3

Business and financial

risk premia and the

required return

CFAI_C19.QXD 10/26/05 5:22 PM Page 524