Hull J.C. Risk management and Financial institutions

Подождите немного. Документ загружается.

Volatility

129

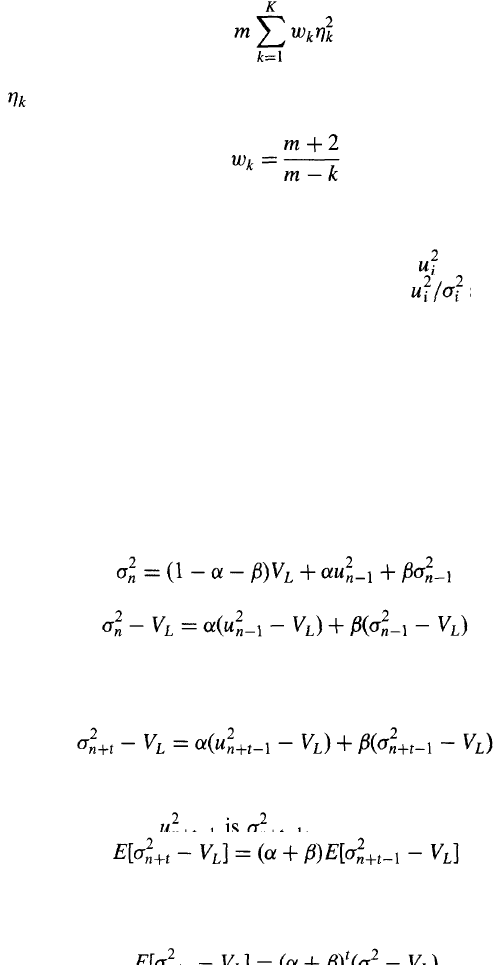

Taking logarithms, we see that this is equivalent to maximizing

This is the same as the expression in equation (5.12), except that is

replaced by We search iteratively to find the parameters in the model

that maximize the expression in equation (5.13).

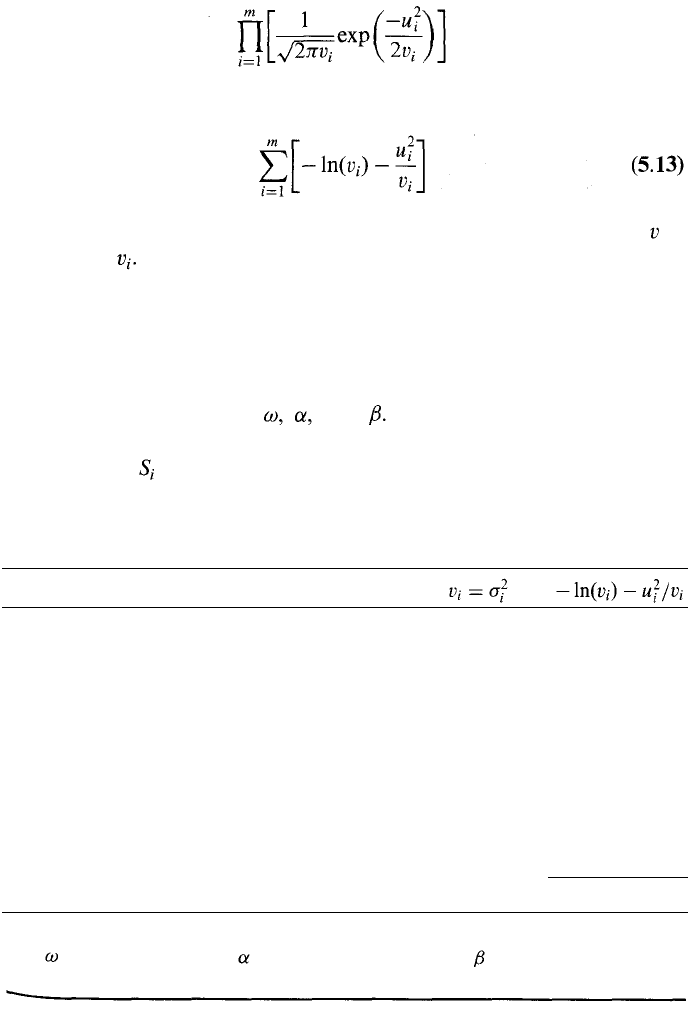

The spreadsheet in Table 5.3 indicates how the calculations could be

organized for the GARCH(1,1) model. The table analyzes data on the

Japanese yen exchange rate between January 6, 1988, and August 15,

1997. The numbers in the table are based on trial estimates of the three

GARCH(1,1) parameters: and The first column in the table

records the date. The second counts the days. The third shows the

exchange rate at the end of day i. The fourth shows the proportional

change in the exchange rate between the end of day i - 1 and the end of

Table 5.3 Estimation of parameters in GARCH(1,1) model.

Date

06-Jan-88

07-Jan-88

08-Jan-88

ll-Jan-88

12-Jan-88

13-Jan-88

13-Aug-97

14-Aug-97

15-Aug-97

Day i

1

2

3

4

5

6

2421

2422

2423

S

i

0.007728

0.007779

0.007746

0.007816

0.007837

0.007924

0.008643

0.008493

0.008495

u

i

0.006599

-0.004242

0.009037

0.002687

0.011101

0.003374

-0.017309

0.000144

0.00004355

0.00004198

0.00004455

0.00004220

0.00007626

0.00007092

0.00008417

9.6283

8.1329

9.8568

7.1529

9.3321

5.3294

9.3824

22,063.5763

Trial estimates of GARCH parameters

0.00000176

0.0626

0.8976

parameters are the ones that maximize

130 Chapter 5

day i. This is The fifth column shows the estimate of

the variance rate for day i made at the end of day i — 1. On day

three, we start things off by setting the variance equal to On sub-

sequent days equation (5.10) is used. The sixth column tabulates the

likelihood measure, The values in the fifth and sixth

columns are based on the current trial estimates of and We are

interested in choosing and to maximize the sum of the numbers in

the sixth column. This involves an iterative search procedure.

10

In our example, the optimal values of the parameters turn out to be

= 0.00000176, =0.0626, =0.8976

and the maximum value of the function in equation (5.13) is 22,063.5763.

The numbers shown in Table 5.3 were calculated on the final iteration of

the search for the optimal and

The long-term variance rate, V

L

, in our example is

The long-term volatility is or 0.665%, per day.

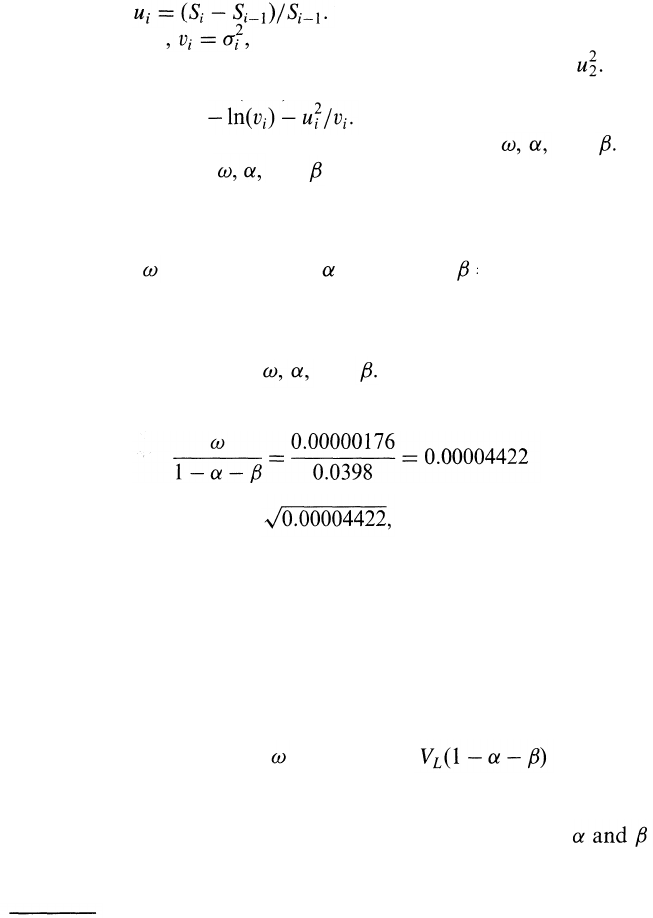

Figure 5.3 shows the way in which the GARCH(1,1) volatility for the

Japanese yen changed over the ten-year period covered by the data. Most

of the time, the volatility was between 0.4% and 0.8% per day, but

volatilities over 1% were experienced during some periods.

An alternative and more robust approach to estimating parameters in

GARCH(1,1) is known as variance targeting.

11

This involves setting the

long-run average variance rate, V

L

, equal to the sample variance calcu-

lated from the data (or to some other value that is believed to be

reasonable.) The value of then equals and only two

parameters have to be estimated. For the data in Table 5.3 the sample

variance is 0.00004341, which gives a daily volatility of 0.659%. Setting

V

L

equal to the sample variance, we find that the values of that

maximize the objective function in equation (5.13) are 0.0607 and 0.8990,

respectively. The value of the objective function is 22,063.5274, only

10

As discussed later, a general purpose algorithm such as Solver in Microsoft's Excel

can be used. Alternatively, a special purpose algorithm, such as Levenberg-Marquardt,

can be used. See, for example, W. H. Press, B.P. Flannery, S.A. Teukolsky, and

W. T. Vetterling. Numerical Recipes in C: The Art of Scientific Computing, Cambridge

University Press, 1988.

11

See R. Engle and J. Mezrich, "GARCH for Groups," Risk, August 1996, 36-40.

131

Jan-88 Jan-89 Jan-90 Jan-91 Jan-92 Jan-93 Jan-94 Jan-95 Jan-96 Jan-97 Jan-98

Figure 5.3 Daily volatility of the yen/USD exchange rate, 1988-97.

marginally below the value of 22,063.5763 obtained using the earlier

procedure.

When the EWMA model is used, the estimation procedure is relatively

simple. We set =0, = 1 — , and and only one parameter has

to be estimated. In the data in Table 5.3, the value of that maximizes the

objective function in equation (5.13) is 0.9686 and the value of the

objective function is 21,995.8377.

Both GARCH(1,1) and the EWMA method can be implemented by

using the Solver routine in Excel to search for the values of the para-

meters that maximize the likelihood function. The routine works well

provided that we structure our spreadsheet so that the parameters we are

[searching for have roughly equal values. For example, in GARCH(1,1)

we could let cells Al, A2, and A3 contain x 10

5

, and 0.1 We could

then set Bl = Al/100,000, B2 = A2, and B3 = 10 * A3. We could use

Bl, B2, and B3 to calculate the likelihood function and then ask Solver to

(calculate the values of Al, A2, and A3 that maximize the likelihood

function.

How Good Is the Model?

The assumption underlying a GARCH model is that volatility changes

with the passage of time. During some periods volatility is relatively high;

[during others it is relatively low. To put this another way, when is high,

Volatility

132 Chapter 5

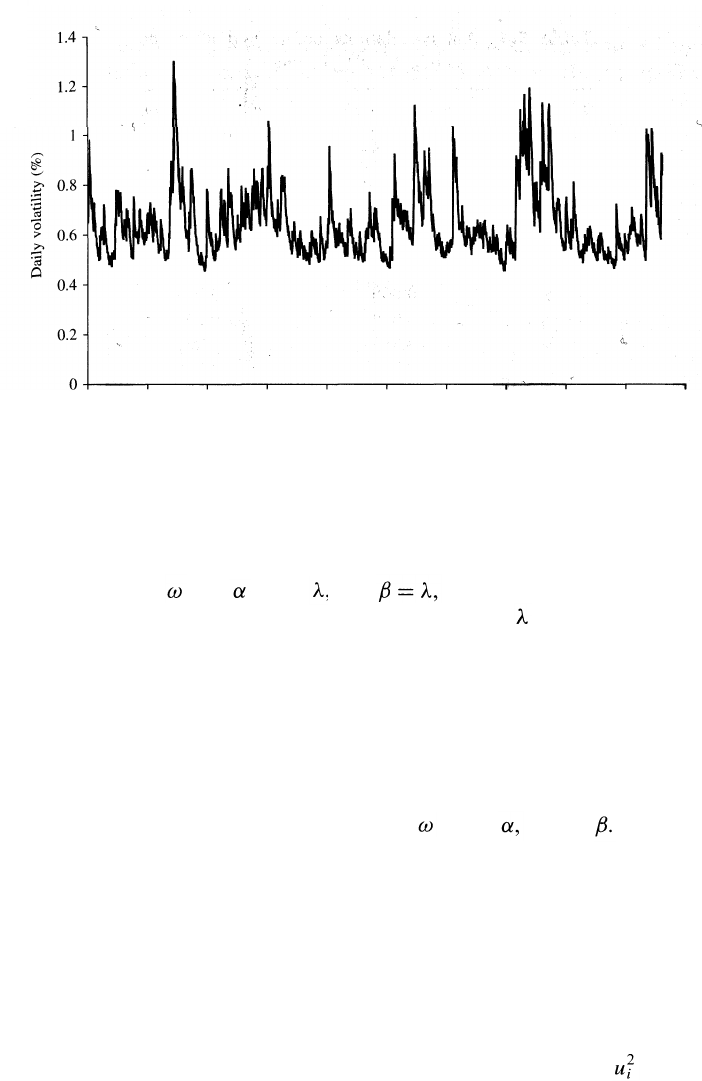

Table 5.4 Autocorrelations before and after the

use of a GARCH model.

Time lag

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Autocorrelation

for

0.072

0.041

0.057

0.107

0.075

0.066

0.019

0.085

0.054

0.030

0.038

0.038 '„

0.057

0.040

0.007

Autocorrelation

for

0.004

-0.005

0.008

0.003

0.016

0.008

-0.033

0.012

0.010

-0.023

-0.004

-0.021

-0.001

0.002

-0.028

there is a tendency for to be high; when is low, there is a

tendency for to be low. We can test how true this is by

examining the autocorrelation structure of the

Let us assume that the do exhibit autocorrelation. If a GARCH

model is working well, it should remove the autocorrelation. We can test

whether it has done this by considering the autocorrelation structure for

the variables If these show very little autocorrelation, our model

foi has succeeded in explaining autocorrelations in the

Table 5.4 shows results for the yen/USD exchange rate data referred to

earlier. The first column shows the lags considered when the autocorrela-

tion is calculated. The second column shows autocorrelations for the

third column shows autocorrelations for The table shows that

the autocorrelations are positive for for all lags between 1 and 15. In

the case of some of the autocorrelations are positive and some are

negative. They tend to be smaller in magnitude than the autocorrelations

for

The GARCH model appears to have done a good job in explaining the

12

For a series the autocorrelation with a lag of k is the coefficient of correlation

between and

Volatility

133

data. For a more scientific test, we can use what is known as the Ljung-

Box statistic.

13

If a certain series has m observations the Ljung-Box

statistic is

where is the autocorrelation for a lag of k, K is the number of lags

considered, and

For K = 15, zero autocorrelation can be rejected with 95% confidence

when the Ljung-Box statistic is greater than 25.

From Table 5.4, the Ljung-Box statistic for the series is about 123.

This is strong evidence of autocorrelation. For the series the Ljung-

Box statistic is 8.2, suggesting that the autocorrelation has been largely

removed by the GARCH model.

5.10 USING GARCH(1,1) TO FORECAST FUTURE

VOLATILITY

The variance rate estimated at the end of day n — 1 for day n, when

GARCH(l,l) is used, is

so that

On day n + t in the future, we have

The expected value of Hence,

where E denotes expected value. Using this equation repeatedly yields

13

See G. M. Ljung and G. E. P. Box, "On a Measure of Lack of Fit in Time Series

Models," Biometrica, 65 (1978), 297-303.

134

Chapter 5

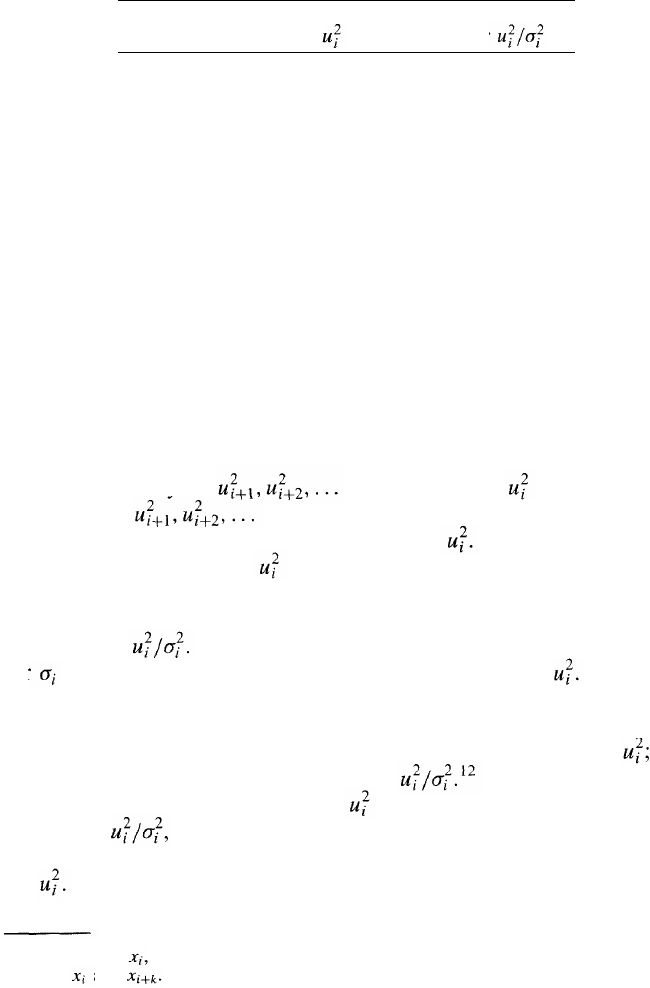

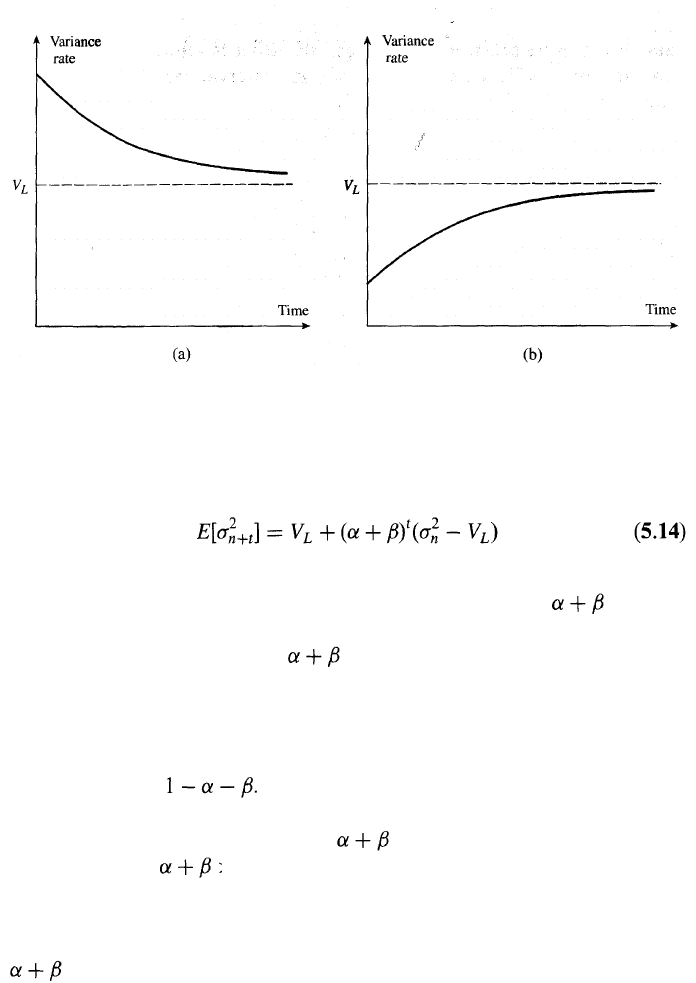

Figure 5.4 Expected path for the variance rate when (a) current variance rate is

above long-term variance rate and (b) current variance rate is below long-term

variance rate.

or

This equation forecasts the volatility on day n +t using the information

available at the end of day n — 1. In the EWMA model, = 1 and

equation (5.14) shows that the expected future variance rate equals the

current variance rate. When < 1, the final term in the equation

becomes progressively smaller as t increases. Figure 5.4 shows the

expected path followed by the variance rate for situations where the

current variance rate is different from V

L

. As mentioned earlier, the

variance rate exhibits mean reversion with a reversion level of V

L

and a

reversion rate of Our forecast of the future variance rate tends

toward V

L

as we look further and further ahead. This analysis empha-

sizes the point that we must have < 1 for a stable GARCH(1,1)

process. When > 1, the weight given to the long-term average

variance is negative and the process is "mean fleeing" rather than "mean

reverting".

In the yen/USD exchange rate example considered earlier,

= 0.9602 and V

L

= 0.00004422. Suppose that our estimate of the

current variance rate per day is 0.00006. (This corresponds to a volatility

of 0.77% per day.) In ten days the expected variance rate is

0.00004422 + 0.9602

10

(0.00006 - 0.00004422) = 0.00005473

Volatility

135

The expected volatility per day is 0.74%, still well above the long-term

volatility of 0.665% per day. However, the expected variance rate in 100

days is

0.00004422 + 0.9602

100

(0.00006 - 0.00004422) = 0.00004449

and the expected volatility per day is 0.667%, very close the long-term

volatility.

Volatility Term Structures

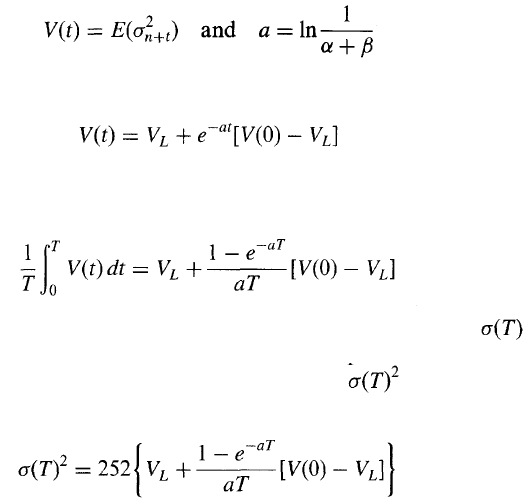

Suppose it is day n. Define

so that equation (5.14) becomes

Here V(t) is an estimate of the instantaneous variance rate in t days. The

average variance rate per day between today and time T is

The longer the life of the option, the closer this is to V

L

. Define as

the volatility per annum that should be used to price a 7-day option

under GARCH(1,1). Assuming 252 days per year, is 252 times the

average variance rate per day, so that

(5.15)

As we discuss in Chapter 15, the market prices of different options on the

same asset are often used to calculate a volatility term structure. This is the

relationship between the implied volatilities of the options and their

maturities. Equation (5.15) can be used to estimate a volatility term

structure based on the GARCH(1,1) model. The estimated volatility term

structure is not usually the same as the actual volatility term structure.

However, as we will show, it is often used to predict the way that the

actual volatility term structure will respond to volatility changes.

When the current volatility is above the long-term volatility, the

136

Chapter 5

GARCH(1,1) model estimates a downward-sloping volatility term struc-

ture. When the current volatility is below the long-term volatility, it

estimates an upward-sloping volatility term structure. In the case of the

yen/USD exchange rate a = ln(l/0.9602) = 0.0406 and V

L

= 0.00004422.

Suppose that the current variance rate per day, V(0) is estimated as

0.00006 per day. It follows from equation (5.15) that

where T is measured in days. Table 5.5 shows the volatility per year for

different values of T.

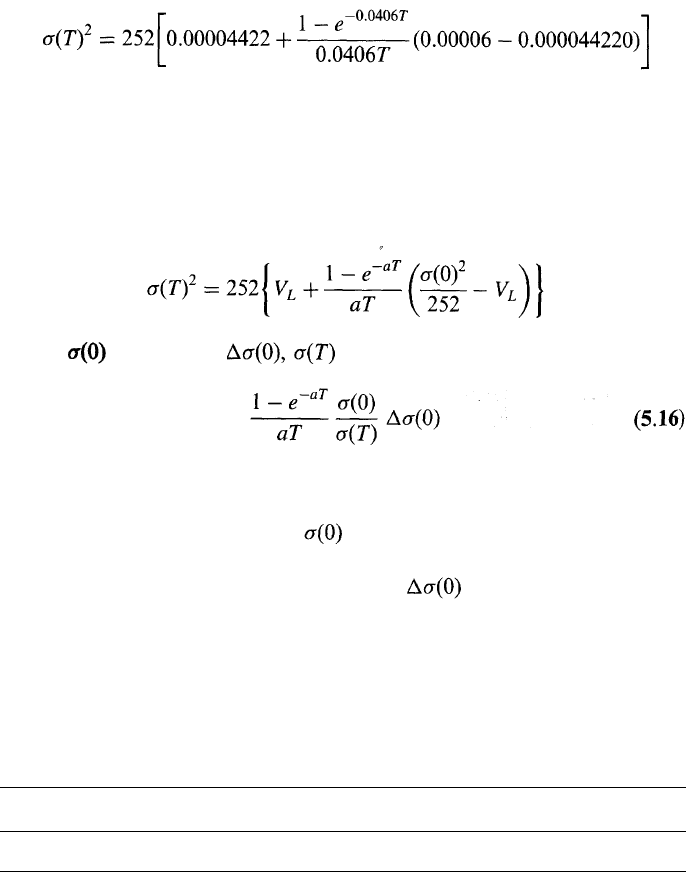

Impact of Volatility Changes

Equation (5.15) can be written as

When changes by changes by

Table 5.6 shows the effect of a volatility change on options of varying

maturities for our yen/USD exchange rate example. We assume as before

that V(0) = 0.00006, so that =12.30%. The table considers a

100-basis-point change in the instantaneous volatility from 12.30% per

year to 13.30% per year. This means that = 0.01, or 1%.

Many financial institutions use analyses such as this when determining

the exposure of their books to volatility changes. Rather than consider an

across-the-board increase of 1% in implied volatilities when calculating

vega, they relate the size of the volatility increase that is considered to the

maturity of the option. Based on Table 5.6, a 0.84% volatility increase

Table 5.5 Yen/USD volatility term structure predicted from GARCH(1, 1).

Option life (days):

Option volatility (% per annum):

10

12.00

30

11.59

50

11.33

100

11.00

500

10.65

Volatility

137

Table 5.6 Impact of 1% change in the instantaneous volatility predicted from

GARCH(1,1).

would be considered for a 10-day option, a 0.61% increase for a 30-day

option, a 0.46% increase for a 50-day option, and so on.

SUMMARY

In option pricing we define the volatility of a variable as the standard

deviation of its continuously compounded return per year. Volatilities are

either estimated from historical data or implied from option prices. In

risk management the daily volatility of a market variable is defined as the

standard deviation of the percentage daily change in the market variable.

The daily variance rate is the square of the daily volatility. Volatility tends

to be much higher on trading days than on nontrading days. As a result

nontrading days are ignored in volatility calculations. It is tempting to

assume that daily changes in market variables are normally distributed.

In fact, this is far from true. Most market variables have distributions for

percentage daily changes with much heavier tails than the normal dis-

tribution. The power law has been found to be a good description of the

tails of many distributions that are encountered in practice, and is often

used for the tails of the distributions of percentage changes in many

market variables.

Most popular option pricing models, such as Black-Scholes, assume

that the volatility of the underlying asset is constant. This assumption is

far from perfect. In practice, the volatility of an asset, like its price, is a

stochastic variable. However, unlike the asset price, it is not directly

observable. This chapter has discussed schemes for attempting to keep

track of the current level of volatility.

We define u

i

, as the percentage change in a market variable between the

end of day i — 1 and the end of day i. The variance rate of the market

variable (i.e., the square of its volatility) is calculated as a weighted

average of the The key feature of the schemes that have been discussed

here is that they do not give equal weight to the observations on the

The more recent an observation, the greater the weight assigned to it. In

the EWMA model and the GARCH(1,1) model, the weights assigned to

Option life (days):

Increase in volatility (%):

10

0.84

30

0.61

50

0.46

100

0.27

500

0.06

138

Chapter 5

observations decrease exponentially as the observations become older.

The GARCH(1,1) model differs from the EWMA model in that some

weight is also assigned to the long-run average variance rate. Both the

EWMA and GARCH(1,1) models have structures that enable forecasts

of the future level of variance rate to be produced relatively easily.

Maximum-likelihood methods are usually used to estimate parameters

in GARCH(1,1) and similar models from historical data. These methods

involve using an iterative procedure to determine the parameter values

that maximize the chance or likelihood that the historical data will occur.

Once its parameters have been determined, a model can be judged by how

well it removes autocorrelation from the

FURTHER READING

On the Causes of Volatility

Fama, E. F., "The Behavior of Stock Market Prices," Journal of Business, 38

(January 1965): 34-105.

French, K. R., "Stock Returns and the Weekend Effect," Journal of Financial

Economics, 8 (March 1980): 55-69.

French, K. R, and R. Roll, "Stock Return Variances: The Arrival of

Information and the Reaction of Traders," Journal of Financial Economics,

17 (September 1986): 5-26.

Roll, R., "Orange Juice and Weather," American Economic Review, 74, No. 5

(December 1984): 861-880.

On GARCH

Bollerslev, T., "Generalized Autoregressive Conditional Heteroscedasticity,"

Journal of Econometrics, 31 (1986): 307-327.

Cumby, R., S. Figlewski, and J. Hasbrook, "Forecasting Volatilities and

Correlations with EGARCH Models," Journal of Derivatives, 1, No. 2 (Winter

1993): 51-63.

Engle, R. F., "Autoregressive Conditional Heteroscedasticity with Estimates of

the Variance of UK Inflation," Econometrica, 50 (1982): 987-1008.

Engle, R.F. and J. Mezrich, "Grappling with GARCH," Risk, September 1995:

112-117.

Engle, R. F., and V. Ng, "Measuring and Testing the Impact of News on

Volatility," Journal of Finance, 48 (1993): 1749-1778.

Nelson, D., "Conditional Heteroscedasticity and Asset Returns; A New

Approach," Econometrica, 59 (1990): 347-370.