Hull J.C. Risk management and Financial institutions

Подождите немного. Документ загружается.

Volatility

139

Noh, J., R. F. Engle, and A. Kane, "Forecasting Volatility and Option Prices of

the S&P 500 Index," Journal of Derivatives, 2 (1994): 17-30.

QUESTIONS AND PROBLEMS (Answers at End of Book)

5.1. The volatility of a stock price is 30% per annum. What is the standard

deviation of the percentage price change in one week?

5.2. The volatility of an asset is 25% per annum. What is the standard

deviation of the percentage price change in one trading day. Assuming a

normal distribution, estimate 95% confidence limits for the percentage

price change in one day.

5.3. Why do traders assume 252 rather than 365 days in a year when using

volatilities?

5.4. What is implied volatility? How can it be calculated? In practice, different

options on the same asset have different implied volatilities. What conclu-

sions do you draw from this?

5.5. Suppose that observations on an exchange rate at the end of the last

11 days have been 0.7000, 0.7010, 0.7070, 0.6999, 0.6970, 0.7003, 0.6951,

0.6953, 0.6934, 0.6923, 0.6922. Estimate the daily volatility using both the

approach in Section 5.3 and the simplified approach in equation (5.4).

5.6. The number of visitors to a website follows the power law given in

equation (5.1) with = 2. Suppose that 1 % of sites get 500 or more visitors

per day. What percentage of sites get (a) 1000 and (b) 2000 or more visitors

per day.

5.7. Explain the exponentially weighted moving average (EWMA) model for

estimating volatility from historical data.

5.8. What is the difference between the exponentially weighted moving average

model and the GARCH(1,1) model for updating volatilities?

5.9. The most recent estimate of the daily volatility of an asset is 1.5% and the

price of the asset at the close of trading yesterday was $30.00. The

parameter in the EWMA model is 0.94. Suppose that the price of the

asset at the close of trading today is $30.50. How will this cause the

volatility to be updated by the EWMA model?

5.l0. A company uses an EWMA model for forecasting volatility. It decides to

change the parameter from 0.95 to 0.85. Explain the likely impact on the

forecasts.

5.l1. Assume that S&P 500 at close of trading yesterday was 1,040 and the daily

volatility of the index was estimated as 1% per day at that time. The

parameters in a GARCH(1,1) model are =0.000002, =0.06, and

140 Chapter 5

= 0.92. If the level of the index at close of trading today is 1,060, what is

the new volatility estimate?

5.12. The most recent estimate of the daily volatility of the USD/GBP exchange

rate is 0.6% and the exchange rate at 4 p.m. yesterday was 1.5000. The

parameter in the EWMA model is 0.9. Suppose that the exchange rate at

4 p.m. today proves to be 1.4950. How would the estimate of the daily

volatility be updated?

5.13. A company uses the GARCH(1,1) model for updating volatility. The

three parameters are and Describe the impact of making a small

increase in each of the parameters while keeping the others fixed.

5.14. The parameters of a GARCH(1,1) model are estimated as = 0.000004,

= 0.05, and = 0.92. What is the long-run average volatility and what is

the equation describing the way that the variance rate reverts to its long-

run average? If the current volatility is 20% per year, what is the expected

volatility in 20 days?

5.15. Suppose that the daily volatility of the FTSE 100 stock index (measured in

GBP) is 1.8% and the daily volatility of the USD/GBP exchange rate is

0.9%. Suppose further that the correlation between the FTSE 100 and the

USD/GBP exchange rate is 0.4. What is the volatility of the FTSE 100

when it is translated to US dollars? Assume that the USD/GBP exchange

rate is expressed as the number of US dollars per pound sterling. (Hint:

When Z = XY, the percentage daily change in Z is approximately equal to

the percentage daily change in X plus the percentage daily change in Y.)

5.16. Suppose that GARCH(1,1) parameters have been estimated as

= 0.000003, =0.04, and =0.94. The current daily volatility is

estimated to be 1%. Estimate the daily volatility in 30 days.

5.17. Suppose that GARCH(1,1) parameters have been estimated as

= 0.000002, =0.04, and =0.94. The current daily volatility is

estimated to be 1.3%. Estimate the volatility per annum that should be

used to price a 20-day option.

ASSIGNMENT QUESTIONS

5.18. Suppose that observations on a stock price (in US dollars) at the end of

each of 15 consecutive weeks are as follows:

30.2, 32.0, 31.1, 30.1, 30.2, 30.3, 30.6, 33.0, 32.9, 33.0, 33.5, 33.5, 33.7, 33.5, 33.2

Estimate the stock price volatility. What is the standard error of your

estimate?

5.19. Suppose that the price of gold at close of trading yesterday was $300 and

its volatility was estimated as 1.3% per day. The price at the close of

Volatility 141

trading today is $298. Update the volatility estimate using (a) the EWMA

model with = 0.94 and (b) the GARCH(1,1) model with =0.000002,

= 0.04, and = 0.94.

5.20. An Excel spreadsheet containing over 900 days of daily data on a number

of different exchange rates and stock indices can be downloaded from the

author's website: http://www.rotman.utoronto.ca/~hull. Choose one

exchange rate and one stock index. Estimate the value of in the EWMA

model that minimizes the value of

where is the variance forecast made at the end of day i — 1 and is the

variance calculated from data between day i and day i + 25. Use the Solver

tool in Excel. To start the EWMA calculations, set the variance forecast at

the end of the first day equal to the square of the return on that day.

5.21. Suppose that the parameters in a GARCH(1,1) model are =0.03,

= 0.95, and = 0.000002. (a) What is the long-run average volatility?

(b) If the current volatility is 1.5% per day, what is your estimate of the

volatility in 20, 40, and 60 days? (c) What volatility should be used to price

20-, 40-, and 60-day options? (d) Suppose that there is an event that

increases the current volatility by 0.5% to 2% per day. Estimate the effect

on the volatility in 20, 40, and 60 days. (e) Estimate by how much the

event increases the volatilities used to price 20-, 40-, and 60-day options.

5.22. An Excel spreadsheet containing over 900 days of daily data on a number

of different exchange rates and stock indices can be downloaded from the

author's website: http://www.rotman.utoronto.ca/~hull. Use the data

and maximum-likelihood methods to estimate for the TSE and S&P

indices the best-fit parameters in an EWMA model and a GARCH(1,1)

model for the variance rate.

Correlations

and Copulas

Suppose a company has an exposure to two different market variables. In

the case of each variable it gains $10 million if there is a one-standard-

deviation increase and loses $10 million if there is a one-standard-

deviation decrease. If changes in the two variables have a high positive

correlation, the company's total exposure is very high; if they have a

correlation of zero, the exposure is less, but still quite large; if they have a

high negative correlation, the exposure is quite low because a loss on one

of the variables is likely to be offset by a gain on the other. This example

shows that it is important for a risk manager to estimate correlations

between the changes in market variables as well as their volatilities when

assessing risk exposures.

This chapter explains how correlations can be monitored in a similar

way to volatilities. It also covers what are known as copulas. These are

tools that provide a way of defining a correlation structure between two

or more variables, regardless of the shapes of their probability distribu-

tions. Copulas will prove to be important in a number of future

chapters. For example, a knowledge of copulas enables some of the

formulas underlying the Basel II capital requirements to be understood

(Chapter 7). Copulas are also useful in modeling default correlation for

the purposes of valuing credit derivatives (Chapter 13) and in the

calculation of economic capital (Chapter 16). The final section of this

chapter explains how copulas can be used to model defaults on port-

folios of loans.

144

Chapter 6

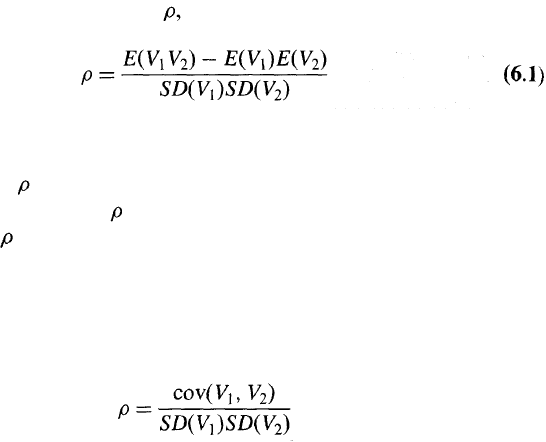

6.1 DEFINITION OF CORRELATION

The coefficient of correlation, between two variables V\ and V

2

is

defined as

where E(•) denotes expected value and SD(•) denotes standard deviation.

If there is no correlation between the variables, then E{V

1

V

2

)=

E(V

1

)E(V

2

) and = 0. If V

1

= V

2

, then the numerator and the denomin-

ator in the expression for are both equal to the variance of V

1

. As we

would expect, = 1 in this case.

The Covariance between V

1

and V

2

is defined as

cov(V

1

, V

2

) = E{V

1

V

2

) - E(V

1

)E(V

2

) (6.2)

so that the correlation can be written

Although it is easier to develop intuition about the meaning of a correl-

ation than a Covariance, it is covariances that will prove to be the

fundamental variables of our analysis. An analogy here is that variance

rates were the fundamental variables for the EWMA and GARCH

methods in Chapter 5, even though volatilities are easier to understand.

Correlation vs. Dependence

Two variables are defined as statistically independent if knowledge about

one of them does not affect the probability distribution for the other.

Formally, V

1

and V

2

and independent if

f(V

2

|V

1

=x) = f(V

2

)

for all x, where f(•) denotes the probability density function.

If the coefficient of correlation between two variables is zero, does this

mean that there is no dependence between the variables? The answer is

no. We can illustrate this with a simple example. Suppose that there are

three equally likely values for V

1

.: -1,0, and +1. If V

1

= — 1 or V

1

= +1,

then V

2

= 1. If V

1

=0, then V

2

= 0. In this case there is clearly a

dependence between V

1

and V

2

. If we observe the value of V

1

we know

the value of V

2

. Also, a knowledge of the value of V

2

will cause us to

Correlations and Copulas

145

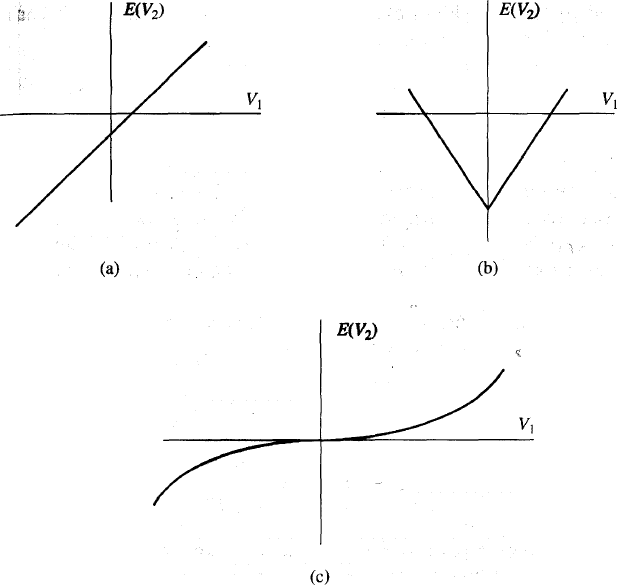

(c)

Figure 6.1 Examples of ways in which V

2

can depend on V

1

.

change our probability distribution for V

1

. However, the coefficient of

correlation between V

1

and V

2

is zero.

This example emphasizes the point that the coefficient of correlation

measures one particular type of dependence between two variables. This

is linear dependence. There are many other ways in which two variables

can be related. We can characterize the nature of the dependence between

V

1

and V

2

by plotting E(V

2

) against V

1

. Three examples are shown in

Figure 6.1. Figure 6.1a shows linear dependence where the expected value

of V

2

depends linearly on V

1

. Figure 6.1b shows a V-shaped relationship

between the expected value of V

2

and V

1

. (This is similar to the example

we have just considered; a symmetrical V-shaped relationship, however

strong, leads to zero coefficient of correlation.) Figure 6.1c shows a type

of dependence that is often seen when V

1

and V

2

are percentage changes

in financial variables. For the values of V

1

normally encountered, there is

very little relation between V

1

and V

2

. However, extreme values of V

1

tend

146

Chapter 6

to lead to extreme values of V

2

. To quote one commentator: "During a

crisis the correlations all go to one."

A similar weighting scheme for variances gives an estimate for the

variance rate on day n for variable X as

and for variable Y as

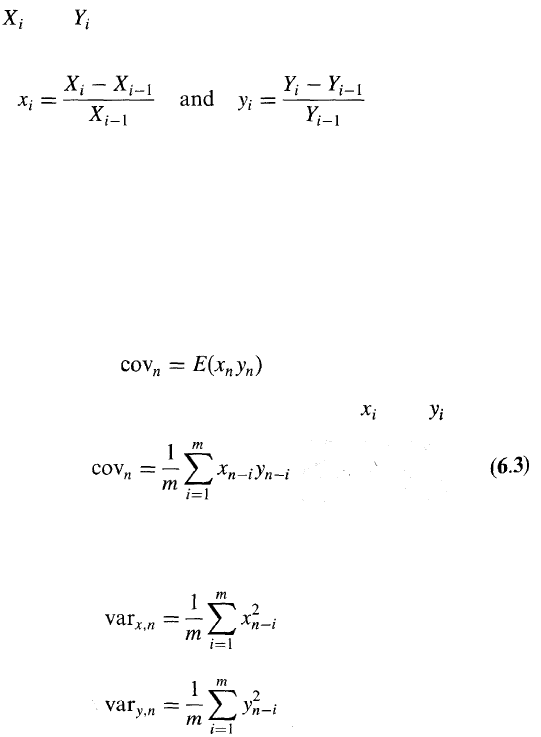

6.2 MONITORING CORRELATION

Chapter 5 explained how EWMA and GARCH methods can be devel-

oped to monitor the variance rate of a variable. Similar approaches can

be used to monitor the Covariance rate between two variables. The

variance rate per day of a variable is the variance of daily returns.

Similarly the Covariance rate per day between two variables is defined

as the Covariance between the daily returns of the variables.

Suppose that and are the values of two variables X and Y at the

end of day i. The returns on the variables on day i are

The Covariance rate between X and Y on day n is, from equation (6.2),

cov

n

= E(x

n

y

n

) - E(x

n

)E(y

n

)

In Section 5.5 we explained that risk managers assume that expected daily

returns are zero when the variance rate per day is calculated. They do the

same when calculating the Covariance rate per day. This means that the

Covariance rate per day between X and Y on day n is simply

Using equal weighting for the last m observations on and

Correlations and Copulas 147

The correlation estimate on day n is

Using EWMA

Most risk managers would agree that observations from far back in the

past should not have as much weight as recent observations. In Chapter 5

we discussed the use of the EWMA model for variances. We saw that it

leads to weights that decline exponentially as we move back through time.

A similar weighting scheme can be used for covariances. The formula for

updating a Covariance estimate in the EWMA model is, similarly to

equation (5.8),

A similar analysis to that presented for the EWMA volatility model shows

that the weight given to declines as i increases (i.e., as we move

back through time). The lower the value of the greater the weight that

is given to recent observations.

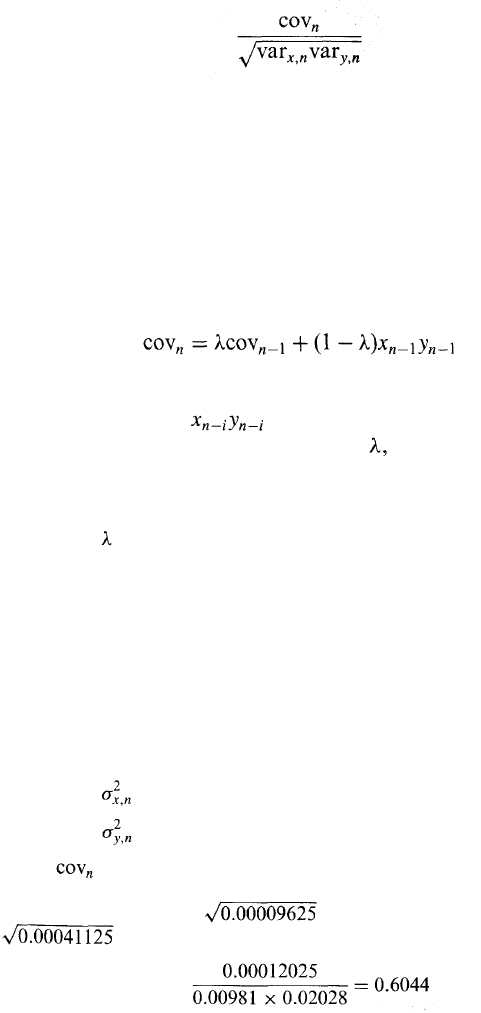

Example 6.1

Suppose that = 0.95 and that the estimate of the correlation between two

variables X and Y on day n — 1 is 0.6. Suppose further that the estimate of the

volatilities for X and Y on day n — 1 are 1% and 2%, respectively. From the

relationship between correlation and Covariance, the estimate of the Covar-

iance rate between X and Y on day n — 1 is

0.6 x 0.01 x 0.02 = 0.00012

Suppose that the percentage changes in X and Y on day n — 1 are 0.5% and

2.5%, respectively. The variance rates and Covariance rate for day n would be

updated as follows:

= 0.95 x 0.01

2

+ 0.05 x 0.005

2

= 0.00009625

= 0.95 x 0.02

2

+ 0.05 x 0.025

2

= 0.00041125

= 0.95 x 0.00012 + 0.05 x 0.005 x 0.025 = 0.00012025

The new volatility of X is = 0.981 % and the new volatility of Y

is = 2.028%. The new correlation between X and Y is

148

Chapter 6

Using GARCH

GARCH models can also be used for updating Covariance rate estimates

and forecasting the future level of Covariance rates. For example, the

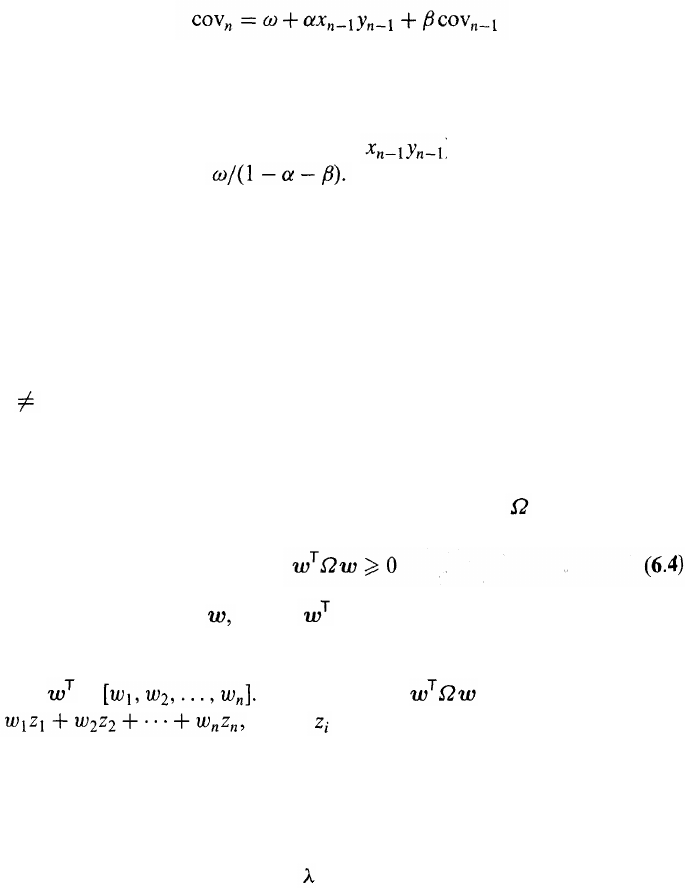

GARCH(1,1) model for updating a Covariance rate between X and Y is

This formula, like its counterpart in equation (5.10) for updating

variances, gives some weight to a long-run average Covariance, some

to the most recent Covariance estimate, and some to the most recent

observation on Covariance (which is ). The long-term average

Covariance rate is Formulas similar to those in

equations (5.14) and (5.15) can be developed for forecasting future

Covariance rates and calculating the average Covariance rate during the

life of an option.

Consistency Condition for Covariances

Once variance and Covariance rates have been calculated for a set of

market variables, a variance-covariance matrix can be constructed. When

i j, the (i, j)th element of this matrix shows the Covariance rate

between the variables i and j; when i = j, it shows the variance rate of

variable i.

Not all variance-covariance matrices are internally consistent. The

condition for an N x N variance-covariance matrix to be internally

consistent is

for all N x 1 vectors where is the transpose of w. A matrix that

satisfies this property is known as Positive-semidefinite.

To understand why the condition in equation (6.4) must hold, suppose

that is The expression is the variance rate of

where is the value of variable i. As such, it

cannot be negative.

To ensure that a Positive-semidefinite matrix is produced, variances and

covariances should be calculated consistently. For example, if variance

rates are calculated by giving equal weight to the last m data items, the

same should be done for Covariance rates. If variance rates are updated

using an EWMA model with = 0.94, the same should be done for

Covariance rates. Multivariate GARCH models, where variance rates

Correlations and Copulas 149

and Covariance rates for a set of variables are updated in a consistent way,

can also be developed.

1

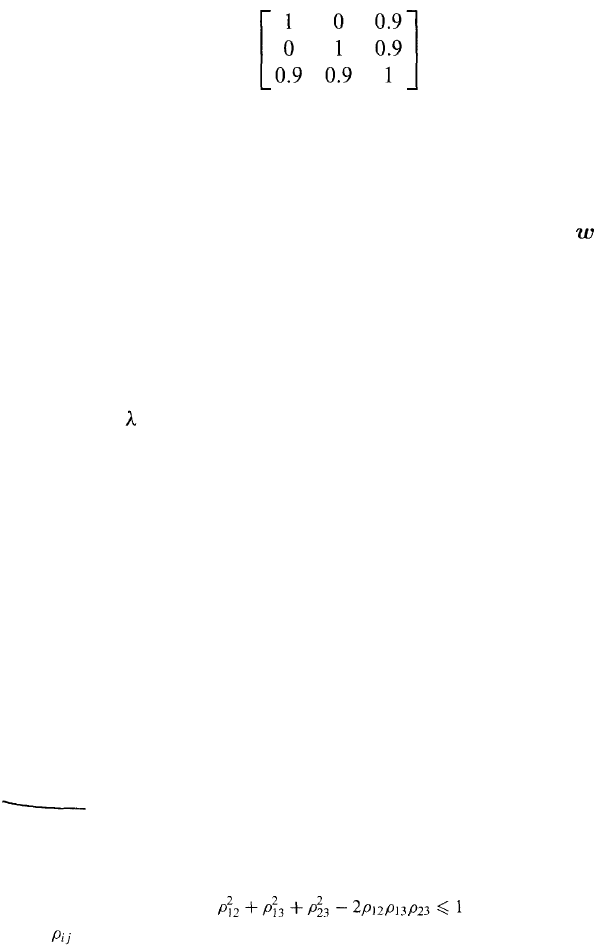

An example of a variance-covariance matrix that is not internally

consistent is

The variance of each variable is 1.0 and so the covariances are also

coefficients of correlation in this case. The first variable is highly correlated

with the third variable, and the second variable is also highly correlated

with the third variable. However, there is no correlation at all between the

first and second variables. This seems strange. When we set equal to

(1,1,-1), we find that the condition in equation (6.4) is not satisfied,

proving that the matrix is not Positive-semidefinite.

2

Variance-covariance matrices that are calculated in a consistent way

from observations on the underlying variables are always Positive-semi-

definite. For example, if we have 500 days of data on three different

variables and use it to calculate a variance-covariance matrix using

EWMA with = 0.94, it will be Positive-semidefinite. If we make a small

change to the matrix (e.g., for the purposes of doing a sensitivity

analysis), it is likely that the matrix will remain Positive-semidefinite.

However, if we do the same thing for observations on 1000 variables,

we have to be much more careful. The 1000 x 1000 matrix that we

calculate from the 500 days of data is Positive-semidefinite, but if we

make an arbitrary small change to the matrix it is quite likely that it will

no longer be Positive-semidefinite.

6.3 MULTIVARIATE NORMAL DISTRIBUTIONS

Multivariate normal distributions are well understood and relatively easy

to deal with. As we will explain in the next section, they can be useful

1

See R. Engle and J. Mezrich, "GARCH for Groups," Risk, August 1996, 36-40, for a

discussion of alternative approaches.

2

It can be shown that the condition for a 3 x 3 matrix of correlations to be internally

consistent is

where is the coefficient of correlation between variables i and j.