Principles of Finance with Excel (Основы финансов c Excel)

Подождите немного. Документ загружается.

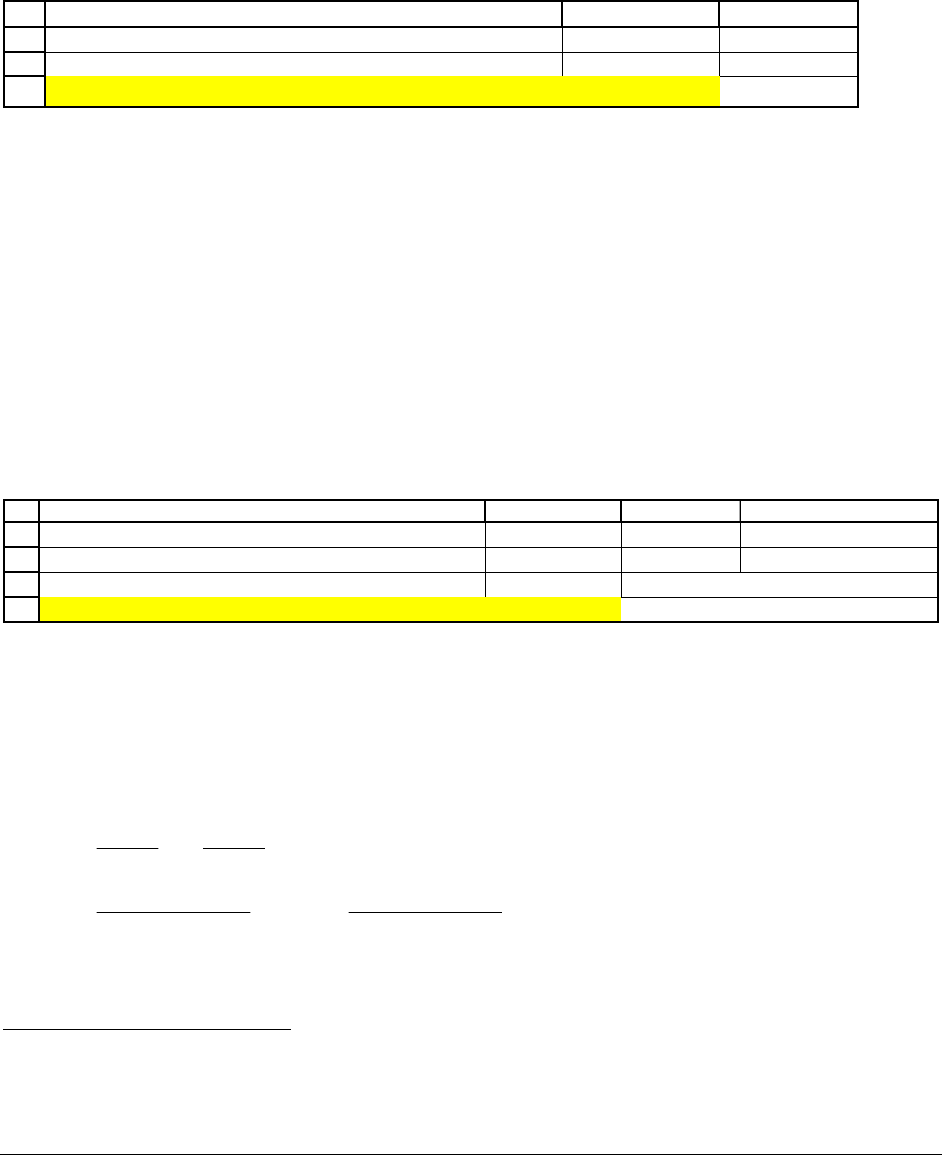

PFE Chapter 19, Stock valuation Page 32

Target’s income tax rate T

C

In 2002 Target paid taxes of $1,022 on earnings of $2,676 (cells B11 and B10

respectively of Figure 19.5). Its income tax rate was therefore 38.19%:

17

18

19

ABC

Earnings before taxes, 2002

2,676

Income taxes

1,022

Corporate tax rate, T

C

38.19% <-- =B18/B17

Computing Target’s cost of equity r

E

using the SML

The SML equation for computing Target’s cost of equity r

E

is given by:

(

)

*

Ef E M f

rr Er r

β

⎡

⎤

=+ −

⎣

⎦

,

Yahoo gives Target’s

β

as 1.16. In February 2003, the risk-free rate r

f

was 2% and the expected

return on the market

(

)

M

Er was 9.68%.

5

This gives Target’s cost of equity as r

E

= 10.91%:

21

22

23

24

ABCD

Equity beta,

β

E

1.16

Risk-free rate, r

f

2%

Expected market return, E(r

M

)

9.68% <-- See discussion below

Cost of equity, r

E

10.91% <-- =B22+B21*(B23-B22)

Putting it all together

Now that we’ve done all the calculations, we can compute Target’s WACC:

()

()

1

25,619 11,161

10.91% 5.84% 1 38.19%

25,619 11,161 25,619 11,161

8.69%

EDC

ED

WACC r r T

ED DE

=+ −

++

=+ −

++

=

5

To see how

()

M

E

r was derived, see the boxed discussion on page000.

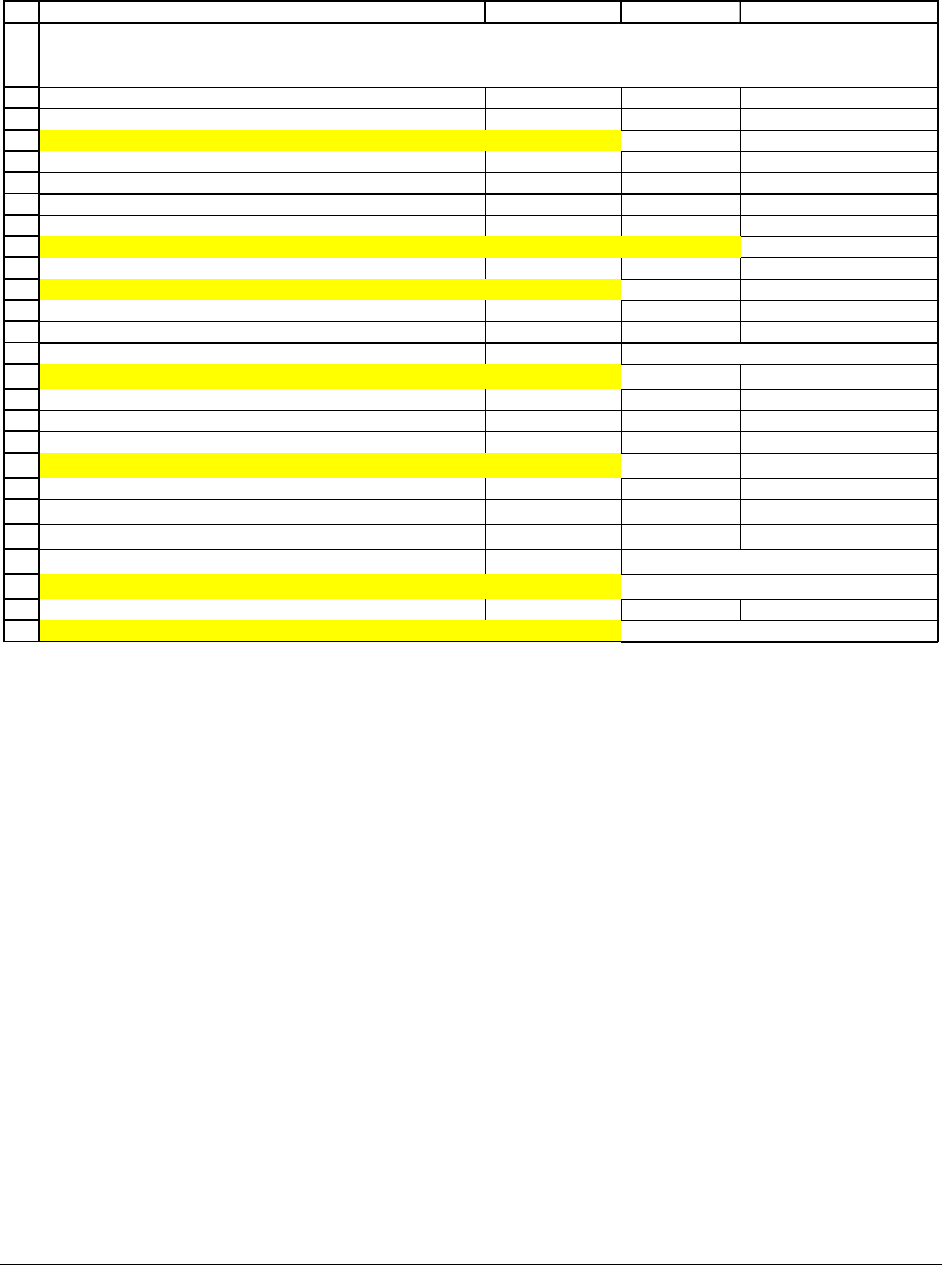

PFE Chapter 19, Stock valuation Page 33

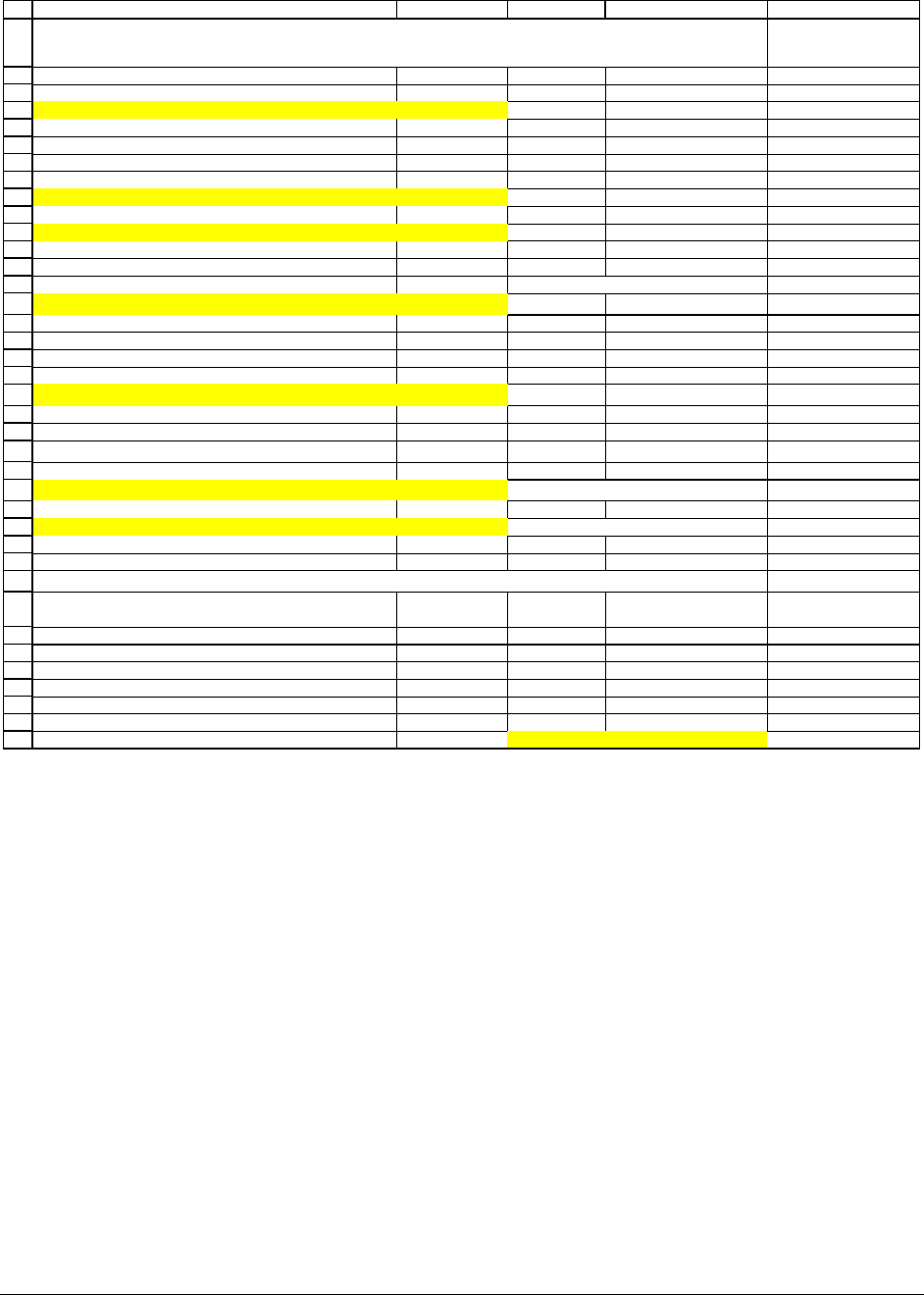

Here it is in a spreadsheet:

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

ABCD

Number of shares (million) 908

Market value per share, 1 February 2002 28.21

Market value of equity 1 February 2002, E 25,619 <-- =B3*B2

2002 2001

Current portion of long-term debt and notes payable 975 905

Long-term debt in 2002 and 2001 (columns B and C)

10,186 8,088

Total debt, D

11,161 8,993 <-- =C8+C7

Market value of Target, E+D

36,780 <-- =B9+B4

Interest paid, 2002

588

Average debt over 2002

10,077 <-- =AVERAGE(B9:C9)

Interest cost, r

D

5.84% <-- =B13/B14

Earnings before taxes, 2002

2,676

Income taxes

1,022

Corporate tax rate, T

C

38.19% <-- =B18/B17

Equity beta, β

E

1.16

Risk-free rate, r

f

2%

Expected market return, E(r

M

)

9.68% <-- See discussion below

Cost of equity, r

E

10.91% <-- =B22+B21*(B23-B22)

WACC 8.69% <-- =B4/B11*B24+(1-B19)*B9/B11*B15

TARGET CORP.'S WACC USING

SML FOR COST OF EQUITY

Computing the expected return on the market

(

)

M

E

r

The most controversial part of estimating the cost of capital using the CAPM is the

estimation of the expected return on the market

(

)

M

Er . We discussed this issue and some

methods of estimation in Chapter 14. To recapitulate: We advocate using a P/E multiple model

for estimating the equity premium. This model, presented in Chapter 14 and briefly reviewed in

the box below, gives us

()

M

Er = 9.68%.

PFE Chapter 19, Stock valuation Page 34

P/E Multiple Model for Estimating E(r

M

)

We start with the payout form of the Gordon dividend model:

(

)

(

)

()

0

00

00

Gordon dividend is the dividend payout

model ratio, EPS is the current

firm earnings per share

00

1*1

*1

/

E

b

Dg bEPSg

rg g

PP

bg

g

PEPS

↑↑

++

=+= +

+

=+

This model is now used to measure the E(r

M

), using current market data:

()

(

)

00

00

*1

/

where

b= (in U.S. around 50%)

g= (educated guess)

/-

M

bg

Er g

P EPS

market payout ratio

growth rate of market earnings

P EPS market price earnings ratio

+

=+

=

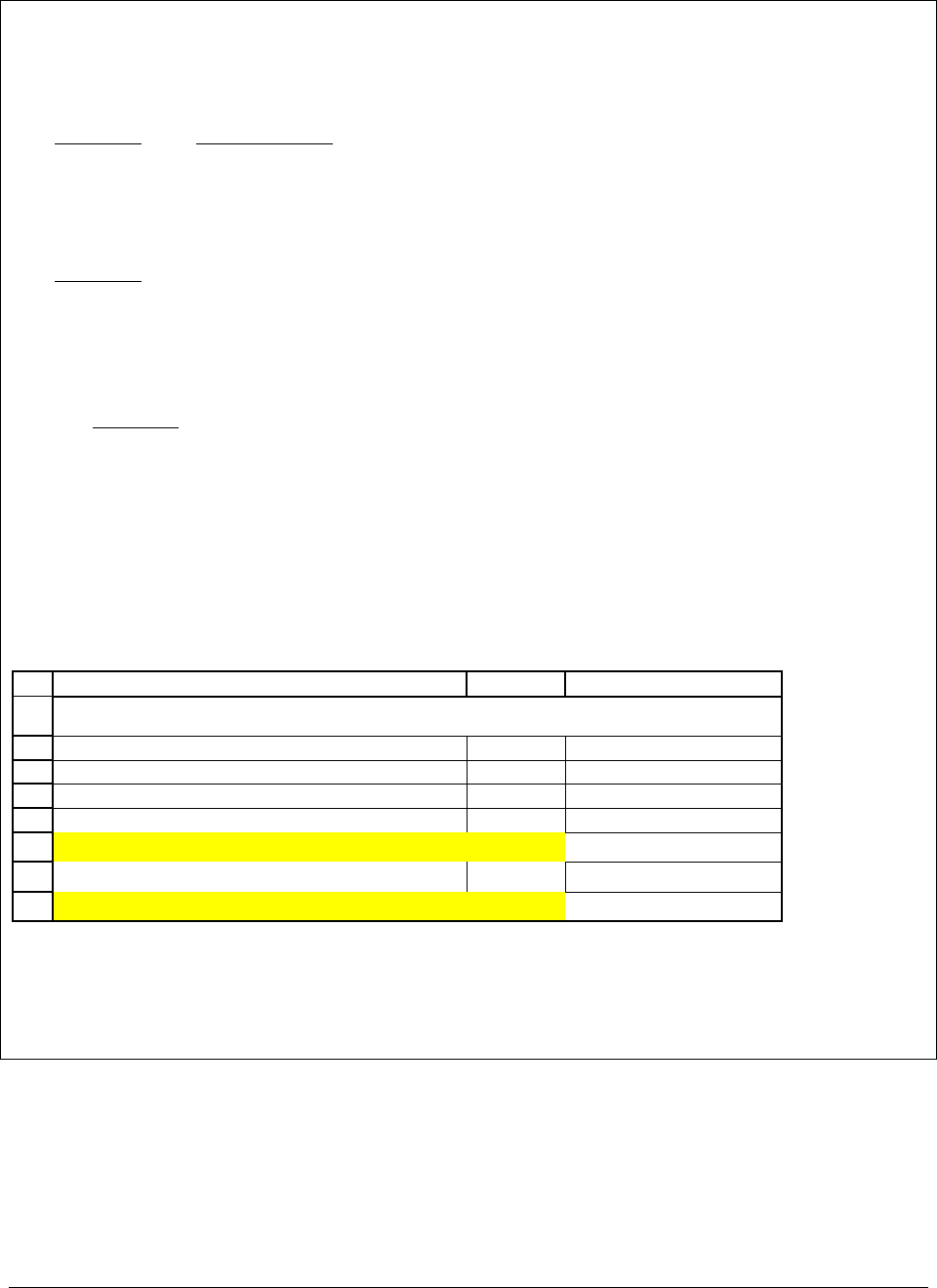

Here’s an Excel example:

1

2

3

4

5

6

7

8

ABC

ESTIMATING E(r

M

) USING THE P/E RATIO

Market P/E ratio 20.00

Market dividend payout ratio,

b

50%

Estimated growth of market earnings,

g

7%

E(r

M

)

9.68% <-- =B3*(1+B4)/B2+B4

Risk-free rate,

r

f

2.00%

Market risk premium, E(r

M

) - r

f

7.68% <-- =B6-B7

We use these values—representative of market parameters in the U.S. in early 2003—in our

determination of the Target Corp. cost of equity r

E

.

PFE Chapter 19, Stock valuation Page 35

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

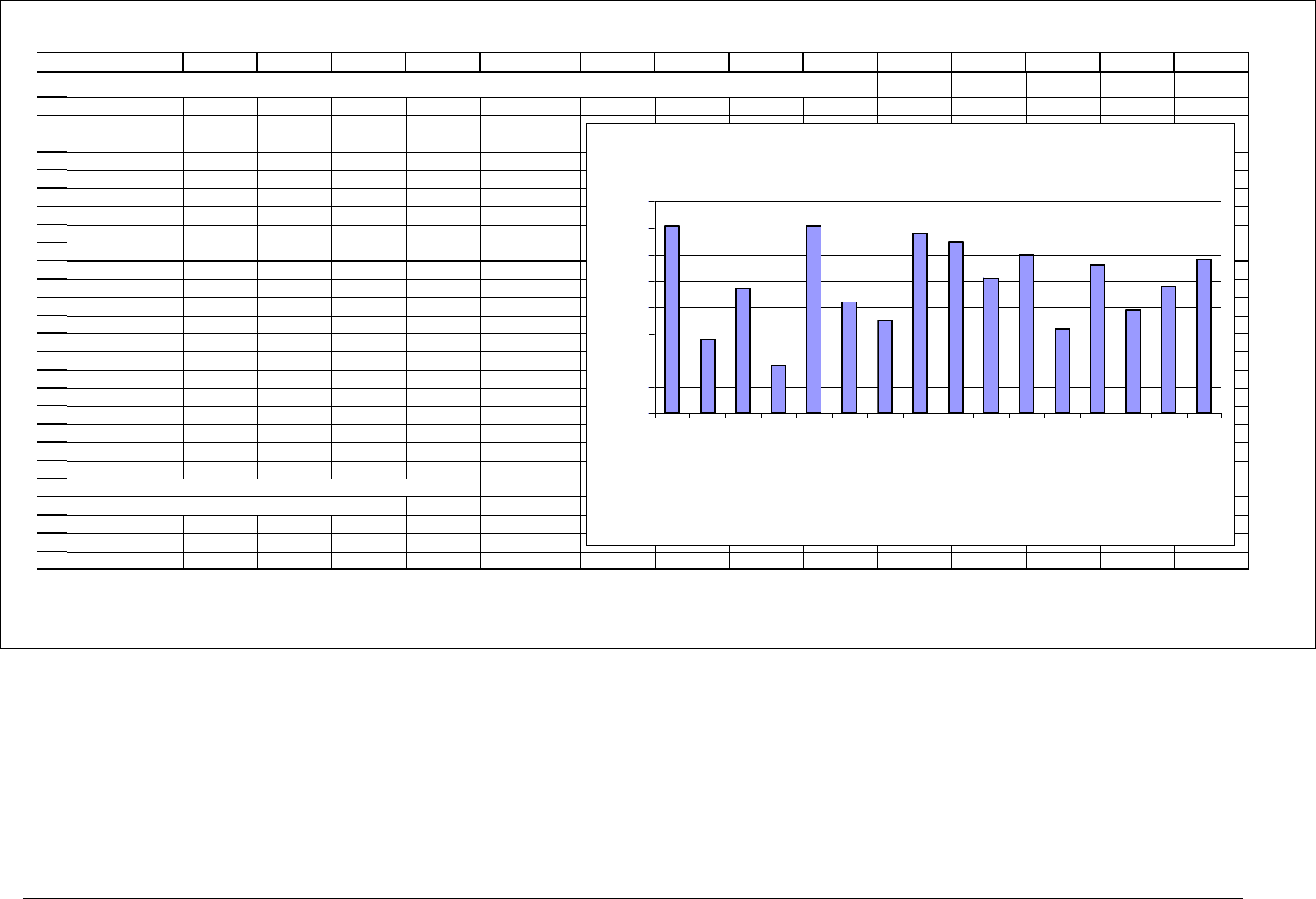

ABCDEFGHIJKLMNO

ANNUALIZED REAL RETURNS ON EQUITIES, BONDS, AND BILLS, 1900-2000

Equities Bonds Bills

Equit

y

premium

Australia 7.50% 1.10% 0.40% 7.10% <-- =B4-D4

Belgium 2.50% -0.40% -0.30% 2.80% <-- =B5-D5

Canada 6.40% 1.80% 1.70% 4.70%

Denmark 4.60% 2.50% 2.80% 1.80%

France 3.80% -1.00% -3.30% 7.10%

Germany 3.60% -2.20% -0.60% 4.20%

Ireland 4.80% 1.50% 1.30% 3.50%

Italy 2.70% -2.20% -4.10% 6.80%

Japan 4.50% -1.60% -2.00% 6.50%

Netherland 5.80% 1.10% 0.70% 5.10%

South Africe 6.80% 1.40% 0.80% 6.00%

Spain 3.60% 1.20% 0.40% 3.20%

Sweden 7.60% 2.40% 2.00% 5.60%

Switzerland 5.00% 2.80% 1.10% 3.90%

United Kingdom 5.80% 1.30% 1.00% 4.80%

United States 6.70% 1.60% 0.90% 5.80%

Average 5.11% 0.71% 0.18% 4.93%

Source : Elroy Dimson, Paul Marsh, Mike Staunton, Triumph

of the Optimists, Princeton University Press 2002

Equity Premium in 16 Countries, 1900-2000

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

Australia

Belgium

Canada

Denmark

France

Germany

Ireland

Italy

Japan

Netherland

South Africe

Spain

Sweden

Switzerland

United Kingdom

United States

Figure 19.6. The equity premium in 16 major economies over the 20

th

century.

PFE Chapter 19, Stock valuation Page 36

19.7. Computing Target’s cost of equity r

E

with the Gordon model

An alternative to the CAPM for computing the cost of equity r

E

is the Gordon model,

which we’ve previously discussed in Chapter 6. The Gordon model says that the equity value is

the discounted value of future anticipated dividends. The standard version of the Gordon model

is:

()

0

0

0

0

1

where

current equity payout of firm (total dividends + stock repurchases)

current market value of equity

anticipated equity payout growth rate

E

Div g

rg

P

Div

P

g

+

=+

=

=

=

For reasons explained in Chapter 6, we think the Gordon model should be used with the

total equity payout, defined as total dividends plus stock repurchases. Below is the calculation

for Target Corp.’s WACC using the Gordon model. The spreadsheet is the same as that of the

previous section, except:

•

Rows 32-36 show Target’s equity payouts—the sum of its dividends and share

repurchases—in each of the last five years. The compound annual growth rate of the

equity payouts is 8.89% per year (cell D38).

•

Rows 22-25 show the Gordon model calculation of the cost of equity r

E

. This is

computed as:

()

(

)

0

0

0

0

1 232* 1 8.89%

8.89% 9.88%

25, 619

where

current equity payout

current market value of equity

anticipated equity payout growth rate

E

Div g

rg

P

Div

P

g

++

=+= +=

=

=

=

PFE Chapter 19, Stock valuation Page 37

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

ABCDE

Number of shares (million) 908

Market value per share, 1 February 2002 28.21

Market value of equity 1 February 2002, E 25,619 <-- =B3*B2

2002 2001

Current portion of long-term debt and notes payable 975 905

Long-term debt

7,523 7,054

Total debt, D

8,498 7,959 <-- =C8+C7

Market value of Target, E+D

34,117 <-- =B9+B4

Interest paid, 2002

588

Average debt over 2002

8,229 <-- =AVERAGE(B9:C9)

Interest cost, r

D

7.15% <-- =B13/B14

2002

Earnings before taxes

2,676

Income taxes

1,022

Corporate tax rate, T

C

38.19% <-- =B19/B18

Current equity value

25,619

Current equity payout, Div

0

232 <-- =D36

Growth rate of equity payout

8.89% <-- =D38

Cost of equity, r

E

, using Gordon model

9.88% <-- =B23*(1+B24)/B22+B24

WACC 8.52% <-- =B4/B11*B25+(1-B20)*B9/B11*B15

Year Dividends Repurchases

Total equity

payout

1998 165 0 165

1999 178 0 178

2000 190 585 775

2001 203 20 223

2002 218 14 232

Growth rate 8.89% <-- =(D36/D32)^(1/4)-1

TARGET CORP.'S WACC USING

GORDON MODEL FOR COST OF EQUITY

Dividends and stock repurchases

Using the Gordon model estimate of the cost of equity, Target’s WACC is 8.52% (cell

B27).

Summing up

This chapter has discussed a grab-bag of share valuation methods. Three of these

methods could be termed “fundamental valuations.” Valuation Method 1, the simplest of the

fundamental valuation methods is based on the assumption of market efficiency and says that a

firm’s stock is worth its current market price. Simple as it is, this approach has a lot of power

PFE Chapter 19, Stock valuation Page 38

and support in the academic community: If market participants have done their work, then the

current price of a share reflects all publicly-available information, and there’s nothing else to do.

Valuation method 2, discounted cash flow (DCF) valuation, is the method preferred by

most finance academics and many finance practitioners. This method is based on discounting

the firm’s projected future free cash flows (FCF) at an appropriate weighted average cost of

capital. The discounted value arrived at in this way is called the firm’s enterprise value. To

arrive at the valuation of the firm’s equity, we add cash and marketable securities to the

enterprise value and subtract the value of the firm’s debt. Dividing by the number of shares

gives the per-share valuation.

Valuation method 3, the direct equity valuation, discounts the projected payouts to equity

holders (defined as the sum of dividends plus share repurchases) by the firm’s cost of equity r

E

.

The resulting present value is the value of the firm’s equity. Although it appears simpler and

more direct than the FCF valuation, direct equity valuation is usually shunned by finance

professionals. This is primarily because the cost of equity is heavily dependent on a firm’s debt-

equity financing mix, whereas the WACC is not nearly as dependent (and perhaps independent)

of the debt-equity mix.

Valuation method 4, multiple valuation is widely used. This method of valuation arrives

at a relative valuation of the firm by comparing a set of relevant multiples for comparable firms.

When used correctly, multiple valuations can be a powerful tool, but it is often difficult to arrive

at a correct “peer group” for a particular firm.

PFE Chapter 19, Stock valuation Page 39

Exercises

PFE Chapter 19 (Appendix), Valuing Procter & Gamble page 1

CHAPTER 19 APPENDIX:

VALUING PROCTER & GAMBLE

*

This version: February 8, 2004

Appendix contents

Overview..............................................................................................................................2

19.A.1. The Gordon model with two dividend growth rates ..............................................2

19.A.2. Computing the FCF growth rate for Procter & Gamble ........................................6

19.A.3. Using the industry asset beta,

β

asset

, to compute the WACC for Procter & Gamble

............................................................................................................................................11

19.A.4. Procter & Gamble’s WACC using the Gordon model and the company’s cost of debt r

D

and its tax rate T

C

...............................................................................................................14

19.A.5. Procter & Gamble: the bottom line on the FCF valuation ..................................17

Conclusion: Procter & Gamble—what happened?...........................................................19

*

This is a preliminary draft of a chapter of Principles of Finance with Excel. © 2001 – 2004 Simon Benninga

(benninga@wharton.upenn.edu

).

PFE Chapter 19 (Appendix), Valuing Procter & Gamble page 2

Overview

This appendix implements a full-blown valuation of the stock of Procter & Gamble

Corporation (PG). In doing so we illustrate some of the tricky implementation issues involved in

the valuation techniques described in Chapter 16. The appendix contains advanced materials,

and can easily be skipped.

In addition to the techniques described in Chapter 16, this appendix introduces two???

new techniques:

• Multiple growth rates and the Gordon model

• Asset betas

19.A.1. The Gordon model with two dividend growth rates

The Gordon model discussed in Chapter 16 (and previously in Chapter 5) assumes that

there equity payouts of the firm will grow at an anticipated future growth rate g. Based on this

assumption we showed that the cost of equity is:

()

0

0

*1

E

Div g

rg

P

+

=+,

where Div

0

is the firm’s current equity payout (defined as the sum of its total dividends and stock

repurchases), g is the growth rate of the equity payout, and P

0

is the firm’s current equity value

(that is, number of shares times the current share price).

The assumption of a single future growth rate may, however, be problematic. Just as for

the FCF examples in section 16.2 we concluded that there might be 2 FCF growth rates, it is

often plausible to assume that there are 2 dividend growth rates. Typically, we assume that an