Hull J.C. Risk management and Financial institutions

Подождите немного. Документ загружается.

82

Chapter 4

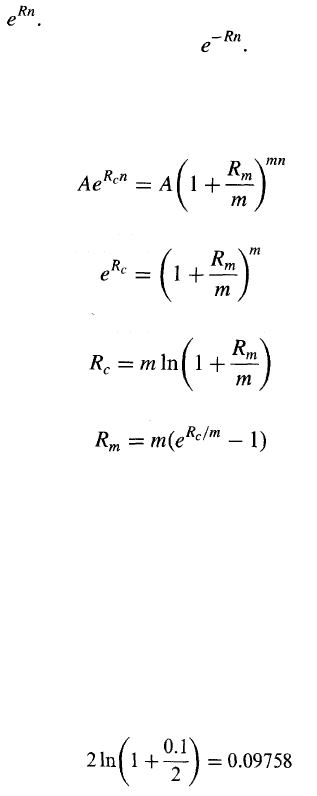

multiplying it by Discounting it at a continuously compounded rate

R for n years involves multiplying by

Suppose that R

c

is a rate of interest with continuous compounding and

R

m

is the equivalent rate with compounding m times per annum. From

the results in equations (4.1) and (4.2), we must have

(4.3)

and

(4.4)

These equations can be used to convert a rate with a compounding

frequency of m times per annum to a continuously compounded rate

and vice versa. The function ln is the natural logarithm function and is

built into most calculators. This function is defined so that, if y = ln x,

then x = e

y

.

Example 4.1

Consider an interest rate that is quoted as 10% per annum with semiannual

compounding. From equation (4.3) with m = 2 and R

m

=0.1, the equivalent

rate with continuous compounding is

or 9.758% per annum.

Example 4.2

Suppose that a lender quotes the interest rate on loans as 8% per annum with

continuous compounding and that interest is actually paid quarterly. From

equation (4.4) with m = 4 and R

c

= 0.08, the equivalent rate with quarterly

compounding is

4(e

0.08/4

-1) = 0.0808

or 8.08% per annum. This means that on a $1,000 loan, interest payments of

$20.20 would be required each quarter:

or

This means that

Interest Rate Risk

83

4.2 ZERO RATES AND FORWARD RATES

The n-year zero-coupon interest rate is the rate of interest earned on an

investment that starts today and lasts for n years. All the interest and

principal is realized at the end of n years. There are no intermediate

payments. The n-year zero-coupon interest rate is sometimes also referred

to as the n-year spot rate, the n-year zero rate, or just the n-year zero. The

zero rate as a function of maturity is referred to as the zero curve. Suppose

a five-year zero rate with continuous compounding is 5% per annum.

This means that $100, if invested for five years, grows to

100 x e

0.05x5

= 128.40

A forward rate is the future zero rate implied by today's zero rates.

Consider the zero rates shown in Table 4.2. The forward rate for the

period between six months and one year is 6.6%. This is because 5% for

the first six months combined with 6.6% for the next six months gives an

average of 5.8% for one year. Similarly, the forward rate for the period

between 12 months and 18 months is 7.6% because this rate when

combined with 5.8% for the first 12 months gives an average of 6.4%

for 18 months. In general, the forward rate F for the period between

times T

1

and T

2

is

(4.5)

where R

1

is the zero rate for maturity of T

1

and R

2

is the zero rate for

maturity T

2

. This formula is exactly correct when rates are measured with

continuous compounding and approximately correct for other com-

pounding frequencies. The results from using this formula on the rates

in Table 4.2 are given in Table 4.3. For example, substituting T

1

= 1.5,

Table 4.2 Zero rates.

Maturity

(years)

0.5

1.0

1.5

2.0

Zero rate

(% cont. comp.)

5.0

5.8

6.4

6.8

84

Chapter 4

Table 4.3 Forward rates for zero rates

in Table 4.2.

Period

(years)

0.5 to 1.0

1.0 to 1.5

1.5 to 2.0

Forward rate

{% cont. comp.)

6.6

7.6

8.0

T

2

= 2.0, R

1

= 0.064, and R

2

= 0.068, we get F = 0.08, showing that the

forward rate for the period between 18 months and 24 months is 8.0%.

Investors who think that future interest rates will be markedly different

from forward rates have no difficulty in finding trades that reflect their

beliefs (see Business Snapshot 4.1).

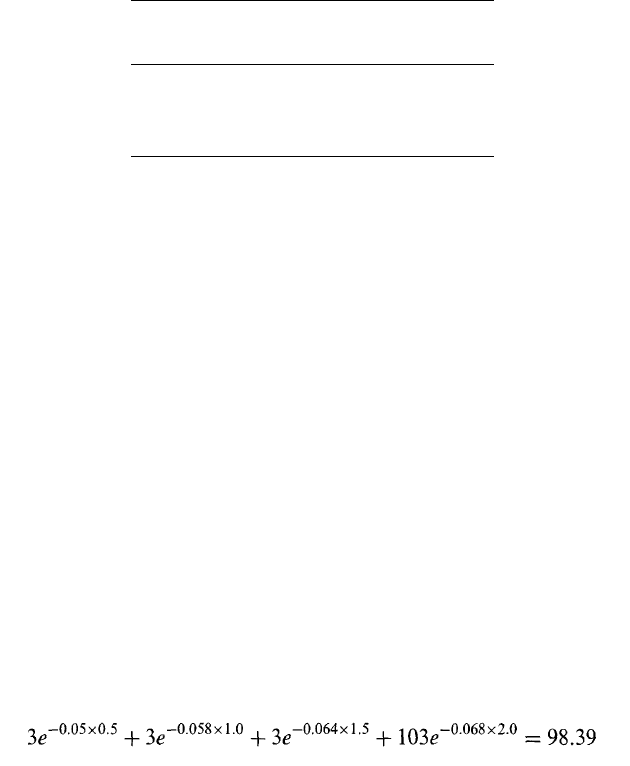

Bond Pricing

Most bonds provide coupons periodically. The bond's principal (also

known as its par value or face value) is received at the end of its life.

The theoretical price of a bond can be calculated as the present value of

all the cash flows that will be received by the owner of the bond. The most

accurate approach is to use a different zero rate for each cash flow. To

illustrate this, consider the situation where zero rates are as shown in

Table 4.2. Suppose that a two-year bond with a principal of $100 provides

coupons at the rate of 6% per annum semiannually. To calculate the

present value of the first coupon of $3, we discount it at 5.0% for six

months; to calculate the present value of the second coupon of $3, we

discount it at 5.8% for one year; and so on. The theoretical price of the

bond is therefore

or $98.39.

Bond Yields

A bond's yield is the discount rate that, when applied to all the bond's

cash flows, equates the bond price to its market price. Suppose that the

theoretical price of the bond we have been considering, $98.39, is also its

market value (i.e., the market's price of the bond is in exact agreement

with the data in Table 4.2). If y is the yield on the bond, expressed with

Interest Rate Risk 85

continuous compounding, we must have

This equation can be solved using Excel's Solver or in some other way to

give y = 6.76%.

4.3 TREASURY RATES

Treasury rates are the rates an investor earns on Treasury bills and

Treasury bonds. These are the instruments used by a government to

borrow in its own currency. Japanese Treasury rates are the rates at which

the Japanese government borrows in yen; US Treasury rates are the rates

at which the US government borrows in US dollars; and so on. It is

Usually assumed that there is no chance that a government will default on

Business Snapshot 4.1 Orange County's Yield Curve Plays

Consider an investor who can borrow or lend at the rates shown in Table 4.2.

Suppose the investor thinks that the six-month interest rates will not change

much over the next three years. The investor can borrow six-month funds and

Invest for two years. The six-month borrowings can be rolled over at the end of

.6, 12. and 18 months. If interest rates do stay about the same, this strategy will

yield a profit of about 1.8% per year because interest will be received at 6.8%

and paid at 5%. This type of trading strategy is known as a yield curve play.

T|he investor is speculating that rates in the future will be quite different from

the forward rates shown in Table 4.3.

Robert Citron, the Treasurer at Orange County, used yield curve plays

similar to the one we have just described very successfully in 1992 and 1993.

The profit from Mr. Citron's trades became an important contributor to

Orange County's budget and he was re-elected. (No-one listened to his

opponent in the election, who said his trading strategy was too risky.)

In 1994 Mr. Citron expanded his yield curve plays. He invested

Heavily in inverse floaters. These pay a rate of interest equal to a fixed

rate of interest minus a floating rate. He also leveraged his position by

Borrowing at short-term interest rates. If short-term interest rates had

remained the same or declined, he would have continued to do well. As

it happened, interest rates rose sharply during 1994. On December 1,

19$94, Orange County announced that its investment portfolio had lost

$1.5 billion and several days later it filed for bankruptcy protection.

86 Chapter 4

an obligation denominated in its own currency.

2

Treasury rates are there-

fore totally risk-free rates in the sense that an investor who buys a

Treasury bill or Treasury bond is certain that interest and principal

payments will be made as promised.

Determining Treasury Zero Rates

One way of determining Treasury zero rates such as those in Table 4.2 is

to observe the yields on "strips". These are zero-coupon bonds that are

synthetically created by traders when they sell the coupons on a Treasury

bond separately from the principal.

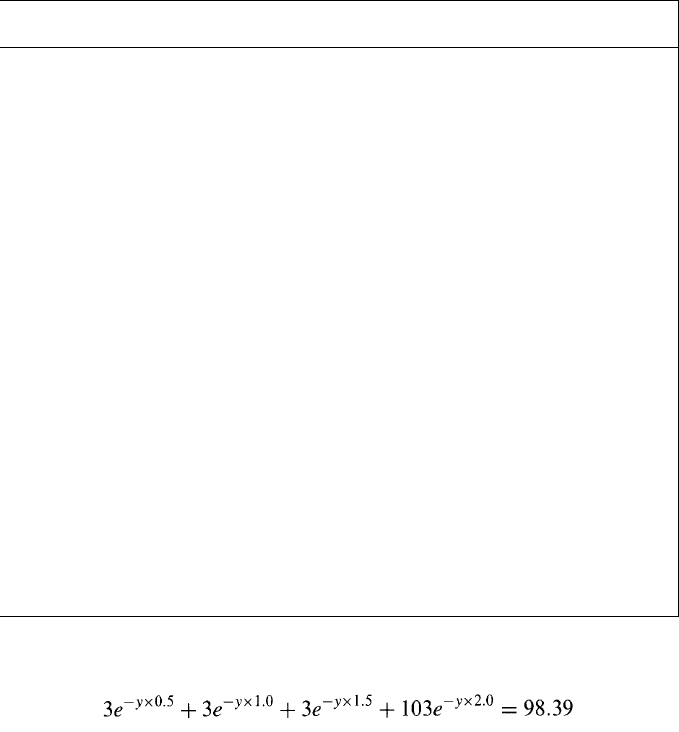

Another way of determining Treasury zero rates is from regular Treas-

ury bills and bonds. The most popular approach is known as the boot-

strap method. This involves working from short maturities to successively

longer maturities and matching prices. Suppose that Table 4.2 gives the

Treasury rates determined so far and that a 2.5-year bond providing a

coupon of 8% sells for $102 per $100 of principal. We would determine

the 2.5-year zero rate as the rate R which, when used in conjunction with

the rates in Table 4.2, gives the correct price for this bond. This involves

solving

which gives R = 7.05%. The complete set of zero rates is shown in

Table 4.4. The zero curve is usually assumed to be linear between the

points that are determined by the bootstrap method. (In our example, the

2.25-year zero rate would be 6.925%.) It is also assumed to be constant

Table 4.4 Rates in Table 4.2 after 2.5-year rate

has been determined using the bootstrap method.

2

The reason for this is that the government can always meet its obligation by printing

more money.

Maturity

(years)

0.5

1.0

1.5

2.0

2.5

Zero rate

(% cont. comp.)

5.00

5.80

6.40

6.80

7.05

Interest Rate Risk 87

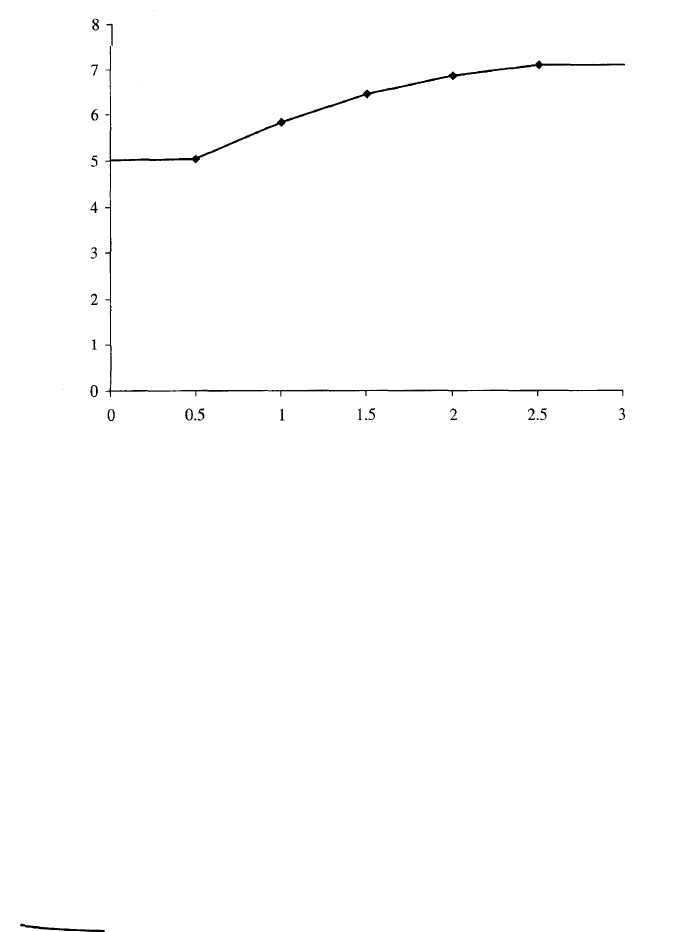

Figure 4.1 Zero curve for data in Table 4.4.

prior to the first point and beyond the last point. The zero curve for our

example is shown in Figure 4.1.

4.4 LIBOR AND SWAP RATES

LIBOR is short for London Interbank Offered Rate. A LIBOR quote by a

particular bank is the rate of interest at which the bank is prepared to

make a large wholesale deposit with another bank.

3

Large banks and

other financial institutions quote 1-month, 3-month, 6-month, and

12-month LIBOR in all major currencies, where 1-month LIBOR is the

rate at which one-month deposits are offered, 3-month LIBOR is the rate

at which three-month deposits are offered, and so on. A deposit with a

bank can be regarded as a loan to that bank. A bank must therefore

satisfy certain creditworthiness criteria to qualify for receiving LIBOR

deposits. Typically, it must have an AA credit rating.

4

Zero rate (%)

Maturity (years)

3

Banks also quote LIBID, the London Interbank Bid Rate. The is the rate at which a

bank is prepared to accept deposits from another bank. The LIBOR quote is slightly

higher than the LIBID quote.

The best credit rating given to a company by the rating agency S&P is AAA. The

second best is AA. The corresponding ratings from the rival rating agency Moody's are

Aaa and Aa, respectively. More details on ratings are in Chapter 11.

88

Chapter 4

LIBOR rates are therefore the 1-month to 12-month borrowing rates

for banks (and other companies) that have AA credit ratings. How can

the LIBOR yield curve be extended beyond one year? There are two ways

of doing this:

1. Create a yield curve to represent the rates at which AA-rated

companies can borrow for periods of time longer than one year.

2. Create a yield curve to represent the future short-term borrowing

rates for AA-rated companies.

It is important to understand the difference. Suppose that the yield curve

is 4% for all maturities. If the yield curve is created in the first way, this

means that AA-rated companies can today lock in an interest rate of 4%

regardless of how long they want to borrow. If the yield curve is created in

the second way, then the forward interest rate that the market assigns to

the short-term borrowing rates of AA-rated companies at future times is

4%. When the yield curve is created in the first way, it gives the forward

short-term borrowing rate for a company that is AA-rated today. When it

is created in the second way, it gives the forward short-term borrowing

rate for a company that will be AA at the beginning of the period covered

by the forward contract.

In practice, the LIBOR yield curve is extended using the second

approach. The LIBOR yield curve is sometimes also called the swap yield

curve or the LIBOR/swap yield curve. The LIBOR/swap zero rates out to

one year are known directly from quoted LIBOR deposit rates. Swap rates

(see Table 2.5) allow the yield curve to be extended beyond one year using

an approach similar to the bootstrap method described for Treasuries in

the previous section.

5

To understand why this is so, consider a bank that

1. Lends a certain principal for six months to an AA borrower and

relends it for successive six month periods to other AA borrowers,

and

2. Enters into a swap to exchange the LIBOR for the five-year swap

rate

These transactions show that the effective interest rate earned from the

series of short-term loans to AA borrowers is equivalent to the swap rate.

This means that the swap yield curve and the LIBOR yield curve (defined

using the second approach above) are the same.

5

Eurodollar futures, which are contracts on the future value of LIBOR, can also be used

to extend the LIBOR yield curve.

Interest Rate Risk 89

The Risk-Free Rate

The risk-free rate is important in the pricing of financial contracts. The

usual practice among financial institutions is to assume that the LIBOR/

swap yield curve provides the risk-free rate. Treasury rates are regarded as

too low to be used as risk-free rates because:

1. Treasury bills and Treasury bonds must be purchased by financial

institutions to fulfill a variety of regulatory requirements. This

increases demand for these Treasury instruments driving their prices

up and their yields down.

2. The amount of capital a bank is required to hold to support an

investment in Treasury bills and bonds is substantially smaller than

the capital required to support a similar investment in other very

low-risk instruments.

3. In the United States, Treasury instruments are given a favorable tax

treatment compared with most other fixed-income investments

because they are not taxed at the state level.

As we have seen, the credit risk in the LIBOR/swap yield curve corres-

ponds to the credit risk in a series of short-term loans to AA-rated

borrowers. It is therefore not totally risk free. There is a small chance

that an AA borrower will default during the life of a short-term loan. But

the LIBOR/swap yield curve is close to risk free and is widely used by

traders as a proxy for the risk-free yield curve. There is some evidence that

a true risk-free yield curve, uninfluenced by the factors affecting Treasury

rates that we have just mentioned, is about 10 basis points (= 0.1%) below

the LIBOR/swap yield curve.

6

By contrast, Treasury rates are about

50 basis points (0.5%) below LIBOR/swap rates on average.

4.5 DURATION

Duration is a widely used measure of a portfolio's exposure to yield curve

movements. As its name implies, the duration of an instrument is a

measure of how long, on average, the holder of the instrument has to

wait before receiving cash payments. A zero-coupon bond that lasts n

years has a duration of n years. However, a coupon-bearing bond lasting

6

See J. Hull, M. Predescu, and A. White, "The Relationship Between Credit Default

Swap Spreads, Bond Yields, and Credit Rating Announcements," Journal of Banking and

Finance, 28 (November 2004), 2789-2811.

90 Chapter 4

n years has a duration of less than n years, because the holder receives

some of the cash payments prior to year n.

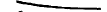

Suppose that a bond provides the holder with cash flows at time

for i = 1,..., n. The price B and yield y (continuously compounded) are

related by

The duration D of the bond is defined as

The term in parentheses is the ratio of the present value of the cash flow at

time to the bond price. The bond price is the present value of all

payments. The duration is therefore a weighted average of the times when

payments are made, with the weight applied to time being equal to the

proportion of the bond's total present value provided by the cash flow at

time . The sum of the weights is 1.0.

When a small change in the yield is considered, it is approximately

true that

(4.9)

From equation (4.6), this becomes

(4.10)

(Note that there is an inverse relationship between B and y. When bond

yields increase, bond prices decrease; and when bond yields decrease,

bond prices increase.) From equations (4.7) and (4.10), we obtain the key

duration relationship

(4.11)

This can be written as

(4.12)

This can be written as

(4.6)

(4.7)

(4.8)

Interest Rate Risk

91

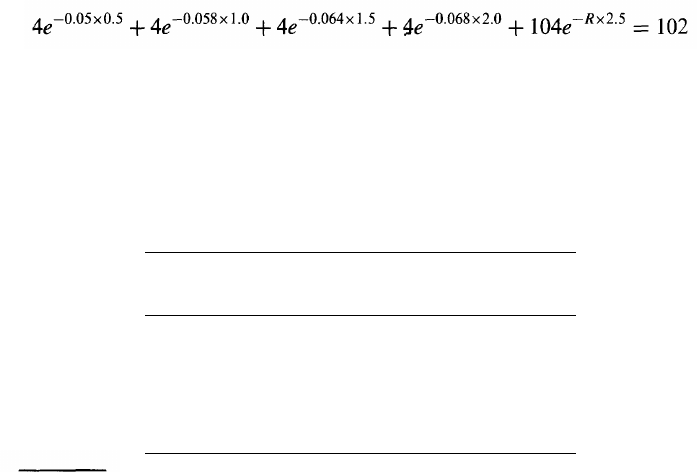

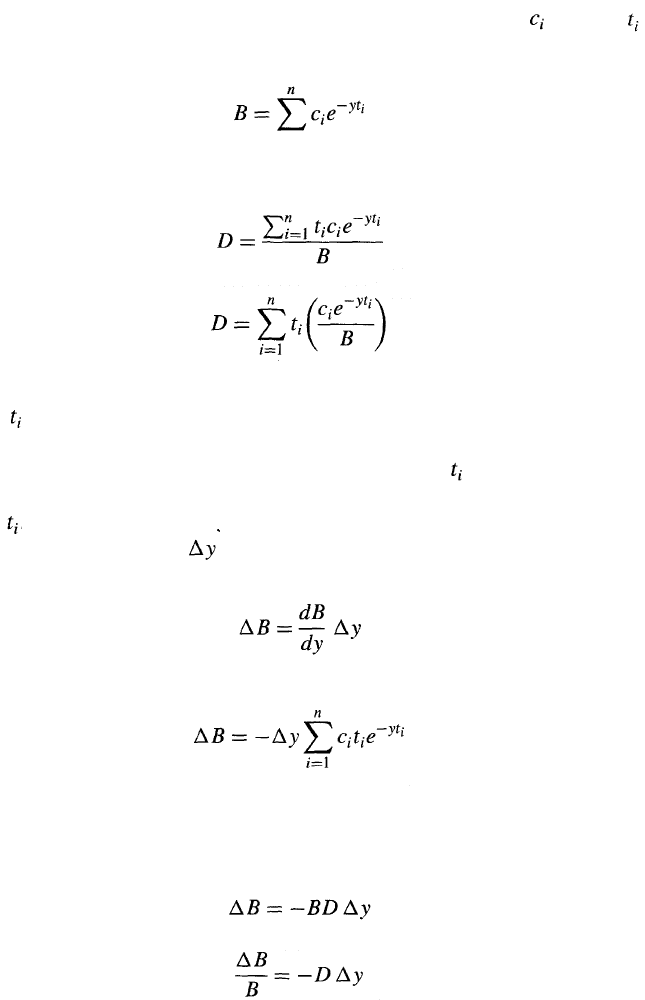

Table 4.5 Calculation of duration.

Equation (4.12) is an approximate relationship between percentage

changes in a bond price and changes in its yield. The equation is easy

to use and is the reason why duration, first suggested by Macaulay in

1938, has become such a popular measure.

Consider a three-year 10% coupon bond with a face value of $100.

Suppose that the yield on the bond is 12% per annum with continuous

compounding. This means that y = 0.12. Coupon payments of $5 are

made every six months. Table 4.5 shows the calculations necessary to

determine the bond's duration. The present values of the bond's cash

flows, using the yield as the discount rate, are shown in column 3. (For

example, the present value of the first cash flow is 5e

-0.12x0.5

— 4.709.)

The sum of the numbers in column 3 gives the bond's price as 94.213. The

weights are calculated by dividing the numbers in column 3 by 94.213.

The sum of the numbers in column 5 gives the duration as 2.653 years.

Small changes in interest rates are often measured in basis points. A

basis point is 0.01% per annum. The following example investigates the

accuracy of the duration relationship in equation (4.11).

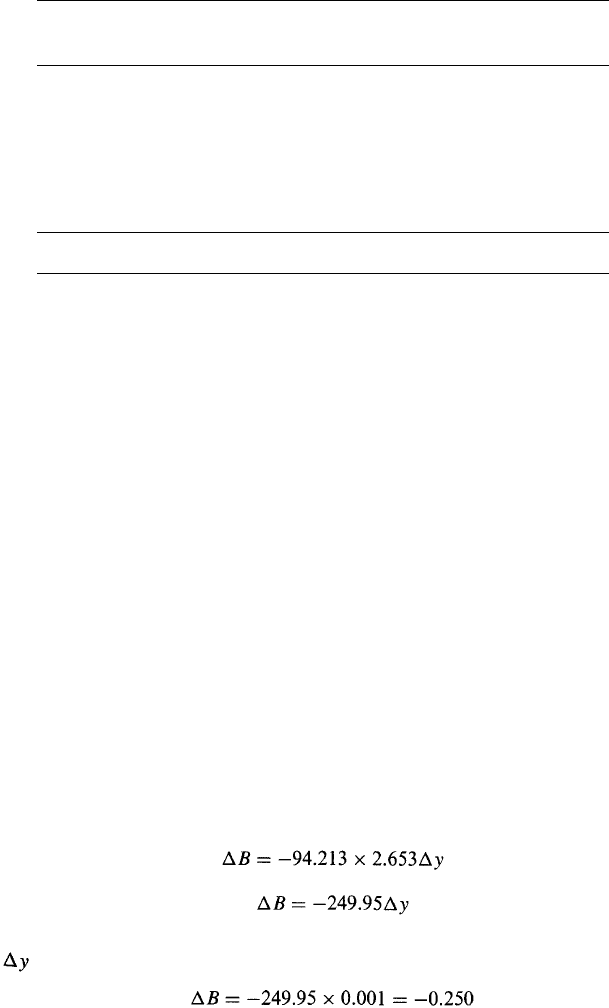

Example 4.5

For the bond in Table 4.5, the bond price B is 94.213 and the duration D is

2.653, so that equation (4.11) gives

or

When the yield on the bond increases by 10 basis points (=0.1%),

= +0.001. The duration relationship predicts that

Time

(years)

0.5

1.0

1.5

2.0

2.5

3.0

Total

Cash flow

($)

5

5

5

5

5

105

130

Present value

($)

4.709

4.435

4.176

3.933

3.704

73.256

94.213

Weight

0.050

0.047

0.044

0.042

0.039

0.778

1.000

Time x Weight

0.025

0.047

0.066

0.083

0.098

2.333

2.653