Investment Banking, valuation and M&A

Подождите немного. Документ загружается.

P1: ABC/ABC P2:c/d QC:e/f T1:g

c04 JWBT063-Rosenbaum March 26, 2009 21:47 Printer Name: Hamilton

Leveraged Buyouts

165

transaction.

8

Once the sponsor chooses the preferred financing structure for an LBO

(often a compilation of the best terms from proposals solicited from several banks),

the deal team presents it to the bank’s internal credit committee(s) for final approval.

Following credit committee approval, the investment banks are able to provide

a financing commitment to support the sponsor’s bid.

9

This commitment offers

funding for the debt portion of the transaction under proposed terms and conditions

(including worst case maximum interest rates (“caps”)) in exchange for various

fees

10

and subject to specific conditions, including the sponsor’s contribution of an

acceptable level of cash equity. This is also known as an underwritten financing,

which traditionally has been required for LBOs due to the need to provide certainty

of closing to the seller (including financing).

11

These letters also typically provide for

a marketing period during which the banks seek to syndicate their commitments to

investors prior to funding the transaction.

For the bank debt, each arranger

12

expects to hold a certain dollar amount

of the revolving credit facility in its loan portfolio, while seeking to syndicate the

remainder along with any term loan(s). As underwriters of the high yield bonds or

mezzanine debt,

13

the investment banks attempt to sell the entire offering to investors

without committing to hold any securities on their balance sheets. However, in an

underwritten financing, the investment banks typically commit to provide a bridge

loan for these securities to provide assurance that sufficient funding will be available

to finance and close the deal.

Bank and Institutional Lenders

Bank and institutional lenders are the capital providers for the bank debt in an

LBO financing structure. Although there is often overlap between them, traditional

bank lenders provide capital for revolvers and amortizing term loans, while institu-

tional lenders provide capital for longer tenored, limited amortization term loans.

8

Alternatively, the banks may be asked to commit to a financing structure already developed

by the sponsor.

9

The financing commitment includes: a commitment letter for the bank debt and a bridge

facility (to be provided by the lender in lieu of a bond financing if the capital markets are

not available at the time the acquisition is consummated); an engagement letter,inwhichthe

sponsor engages the investment banks to underwrite the bonds on behalf of the issuer; and a fee

letter, which sets forth the various fees to be paid to the investment banks in connection with

the financing. Traditionally, in an LBO, the sponsor has been required to provide certainty of

financing and, therefore, had to pay for a bridge financing commitment even if it was unlikely

that the bridge would be funded.

10

The fees associated with the commitment compensate the banks for their underwriting role

and the risk associated with the pledge to fund the transaction in the event that a syndication

to outside investors is not achievable.

11

The credit crunch has resulted in certain sellers loosening this requirement and accepting

bids with financing conditions.

12

The primary investment banks responsible for marketing the bank debt, including the prepa-

ration of marketing materials and running the syndication, are referred to as “Lead Arrangers”

or “Bookrunners.”

13

The lead investment banks responsible for marketing the high yield bonds or mezzanine

debt are referred to as “Bookrunners.”

P1: ABC/ABC P2:c/d QC:e/f T1:g

c04 JWBT063-Rosenbaum March 26, 2009 21:47 Printer Name: Hamilton

166 LEVERAGED BUYOUTS

Bank lenders typically consist of commercial banks, savings and loan institutions,

finance companies, and the investment banks serving as arrangers. The institutional

lender base is largely comprised of hedge funds, pension funds, prime funds, insur-

ance companies, and structured vehicles such as collateralized debt obligation funds

(CDOs).

14

Like investment banks, lenders perform due diligence and undergo an internal

credit process before participating in an LBO financing. This involves analyzing the

target’s business and credit profile (with a focus on projected cash flow generation

and credit statistics) to gain comfort that they will receive full future interest payments

and principal repayment at maturity. Lenders also look to mitigate downside risk

by requiring covenants and collateral coverage. Prior experience with a given credit,

sector, or particular sponsor is also factored into the decision to participate. To

a great extent, however, lenders rely on the diligence performed (and materials

prepared) by the lead arrangers.

As part of their diligence process, prospective lenders attend a group meeting

known as a “bank meeting,” which is organized by the lead arrangers.

15

In a bank

meeting, the target’s senior management team gives a detailed slideshow presenta-

tion about the company and its investment merits, followed by an overview of the

offering by the lead arrangers and a Q&A session. At the bank meeting, prospective

lenders receive a hard copy of the presentation, as well as a confidential information

memorandum (CIM or “bank book”) prepared by management and the lead ar-

rangers.

16

As lenders go through their internal credit processes and make their final

investment decisions, they conduct follow-up diligence that often involves requesting

additional information and analysis from the company.

Bond Investors

Bond investors are the purchasers of the high yield bonds issued as part of the LBO

financing structure. They generally include high yield mutual funds, hedge funds,

pension funds, insurance companies, distressed debt funds, and CDOs.

As part of their investment assessment and decision-making process, bond in-

vestors attend one-on-one meetings, known as “roadshow presentations,” during

14

CDOs are asset-backed securities (“securitized”) backed by interests in pools of assets,

usually some type of debt obligation. When the interests in the pool are loans, the vehicle is

called a collateralized loan obligation (CLO). When the interests in the pool are bonds, the

vehicle is called a collateralized bond obligation (CBO).

15

For particularly large or complex transactions, the target’s management may present to

lenders on a one-on-one basis.

16

The bank book is a comprehensive document that contains a detailed description of the

transaction, investment highlights, company, and sector, as well as preliminary term sheets

and historical and projected financials. In the event that publicly registered bonds are con-

templated as part of the offering, two versions of the CIM are usually created—a public

version and a private version (or private supplement). The public version, which excludes

financial projections and forward-looking statements, is distributed to lenders who intend

to purchase bonds or other securities that will eventually be registered with the SEC. The

private version, on the other hand, includes financial projections as it is used by investors

that intend to invest solely in the company’s unregistered debt (i.e., bank debt). Both the

bank meeting presentation and bank book are typically available to lenders through an online

medium.

P1: ABC/ABC P2:c/d QC:e/f T1:g

c04 JWBT063-Rosenbaum March 26, 2009 21:47 Printer Name: Hamilton

Leveraged Buyouts

167

which senior executives present the investment merits of the company and the pro-

posed transaction. A roadshow is typically a one- to two-week process (depend-

ing on the size and scope of the transaction), where bankers from the lead under-

writing institution (and generally an individual from the sponsor team) accompany

the target’s management on meetings with potential investors. These meetings may

also be conducted as breakfasts or luncheons with groups of investors. The typi-

cal U.S. roadshow includes stops in the larger financial centers such as New York,

Boston, Los Angeles, and San Francisco, as well as smaller cities throughout the

country.

17,18

Prior to the roadshow meeting, bond investors receive a preliminary offering

memorandum (OM), which is a legal document containing much of the target’s busi-

ness, industry, and financial information found in the bank book. The preliminary

OM, however, must satisfy a higher degree of legal scrutiny and disclosure (includ-

ing risk factors

19

). Unlike bank debt, most bonds are eventually registered with the

SEC (so they can be traded on an exchange) and are therefore subject to regulation

under the Securities Act of 1933 and the Securities Exchange Act of 1934.

20

The

preliminary OM also contains detailed information on the bonds, including a pre-

liminary term sheet (excluding pricing) and a description of notes (DON).

21

Once

the roadshow concludes and the bonds have been priced, the final terms are inserted

into the document, which is then distributed to bond investors as the final OM.

Target Management

Management plays a crucial role in the marketing of the target to potential buyers

(see Chapter 6) and lenders alike, working closely with the bankers on the prepara-

tion of marketing materials and financial information. Management also serves as

the primary face of the company and must articulate the investment merits of the

transaction to these constituents. Consequently, in an LBO, a strong management

team can create tangible value by driving favorable financing terms and pricing, as

well as providing sponsors with comfort to stretch on valuation.

From a structuring perspective, management typically holds a meaningful equity

interest in the post-LBO company through “rolling” its existing equity or investing in

the business alongside the sponsor at closing. Several layers of management typically

also have the opportunity to participate (on a post-closing basis) in a stock option-

based compensation package, generally tied to an agreed upon set of financial targets

for the company.

22

This structure provides management with meaningful economic

17

For example, roadshow schedules often include stops in Philadelphia, Baltimore, Minneapo-

lis, Milwaukee, Chicago, and Houston, as well as various cities throughout New Jersey and

Connecticut, in accordance with where the underwriters believe there will be investor interest.

18

European roadshows include primary stops in London, Paris, and Frankfurt, as well as

secondary stops typically in Milan, Edinburgh, Zurich, and Amsterdam.

19

A discussion of the most significant factors that make the offering speculative or risky.

20

Laws that set forth requirements for securities listed on public exchanges, including regis-

tration and periodic disclosures of financial status, among others.

21

The DON contains an overview of the material provisions of the bond indenture including

key definitions, terms, and covenants.

22

These option incentives may comprise up to 15% of the equity value of the company (and

are realized by management upon a sale or IPO).

P1: ABC/ABC P2:c/d QC:e/f T1:g

c04 JWBT063-Rosenbaum March 26, 2009 21:47 Printer Name: Hamilton

168 LEVERAGED BUYOUTS

incentives to improve the company’s performance as they share in the equity upside.

As a result, management and sponsor interests are aligned in pursuing superior

performance. The broad-based equity incentive program outlined above is often a

key differentiating factor versus a public company structure.

Management Buyout An LBO originated and led by a target’s existing management

team is referred to as a management buyout (MBO). Often, an MBO is effected

with the help of an equity partner, such as a financial sponsor, who provides cap-

ital support and access to debt financing through established investment banking

relationships. The basic premise behind an MBO is that the management team be-

lieves it can create more value running the company on its own than under current

ownership. The MBO structure also serves to eliminate the conflict between man-

agement and the board of directors/shareholders as owner-managers are able to run

the company as they see fit.

Public company management may be motivated by the belief that the mar-

ket is undervaluing the company, SEC and Sarbanes-Oxley (SOX)

23

compliance is

too burdensome and costly (especially for smaller companies), and/or the company

could operate more efficiently as a private entity. LBO candidates with sizeable man-

agement ownership are generally strong MBO candidates. Another common MBO

scenario involves a buyout by the management of a division or subsidiary of a larger

corporation who believe they can run the business better separate from the parent.

CHARACTERISTICS OF A STRONG LBO CANDIDATE

Financial sponsors as a group are highly flexible investors that seek attractive in-

vestment opportunities across a broad range of sectors, geographies, and situations.

While there are few steadfast rules, certain common traits emerge among traditional

LBO candidates, as outlined in Exhibit 4.3.

EXHIBIT 4.3

Characteristics of a Strong LBO Candidate

Strong Cash Flow Generation

Leading and Defensible Market Positions

Growth Opportunities

Efficiency Enhancement Opportunities

Low Capex Requirements

Strong Asset Base

Proven Management Team

23

The Sarbanes-Oxley Act of 2002 enacted substantial changes to the securities laws that

govern public companies and their officers and directors in regards to corporate governance

and financial reporting. Most notably, Section 404 of SOX requires public registrants to

establish and maintain “Internal Controls and Procedures,” which can consume significant

internal resources, time, commitment, and expense.

P1: ABC/ABC P2:c/d QC:e/f T1:g

c04 JWBT063-Rosenbaum March 26, 2009 21:47 Printer Name: Hamilton

Leveraged Buyouts

169

During due diligence, the sponsor studies and evaluates an LBO candidate’s key

strengths and risks. Often, LBO candidates are identified among non-core or un-

derperforming divisions of larger companies, neglected or troubled companies with

turnaround potential, or companies in fragmented markets as platforms for a roll-up

strategy.

24

In many instances, the target is simply a solidly performing company with

a compelling business model, defensible competitive position, and strong growth op-

portunities. For a publicly traded LBO candidate, a sponsor may perceive the target as

undervalued by the market or recognize opportunities for growth and efficiency not

being exploited by current management. Regardless of the situation, the target only

represents an attractive LBO opportunity if it can be purchased at a price and utilizing

a financing structure that provides sufficient returns with a viable exit strategy.

Strong Cash Flow Generation

The ability to generate strong, predictable cash flow is critical for LBO candidates

given the highly leveraged capital structure. Debt investors require a business model

that demonstrates the ability to support periodic interest payments and debt repay-

ment over the life of the loans and securities. Business characteristics that support

the predictability of robust cash flow increase a company’s attractiveness as an LBO

candidate. For example, many strong LBO candidates operate in a mature or niche

business with stable customer demand and end markets. They often feature a strong

brand name, established customer base, and/or long-term sales contracts, all of which

serve to increase the predictability of cash flow. Prospective buyers and financing

providers seek to confirm a given LBO candidate’s cash flow generation during due

diligence to gain the requisite level of comfort with the target management’s projec-

tions. Cash flow projections are usually stress-tested (sensitized) based on historical

volatility and potential future business and economic conditions to ensure the ability

to support the LBO financing structure under challenging circumstances.

Leading and Defensible Market Positions

Leading and defensible market positions generally reflect entrenched customer rela-

tionships, brand name recognition, superior products and services, a favorable cost

structure, and scale advantages, among other attributes. These qualities create bar-

riers to entry and increase the stability and predictability of a company’s cash flow.

Accordingly, the sponsor spends a great deal of time during due diligence seeking

assurance that the target’s market positions are secure (and can potentially be ex-

panded). Depending on the sponsor’s familiarity with the sector, consultants may be

hired to perform independent studies analyzing market share and barriers to entry.

Growth Opportunities

Sponsors seek companies with growth potential, both organically and through po-

tential future bolt-on acquisitions. Profitable top line growth at above-market rates

24

A roll-up strategy involves consolidating multiple companies in a given market or sector to

create an entity with increased size, scale, and efficiency.

P1: ABC/ABC P2:c/d QC:e/f T1:g

c04 JWBT063-Rosenbaum March 26, 2009 21:47 Printer Name: Hamilton

170 LEVERAGED BUYOUTS

helps drive outsized returns, generating greater cash available for debt repayment

while also increasing EBITDA and enterprise value. Growth also enhances the speed

and optionality for exit opportunities. For example, a strong growth profile is par-

ticularly important if the target is designated for an eventual IPO exit.

Companies with robust growth profiles have a greater likelihood of driving

EBITDA “multiple expansion”

25

during the sponsor’s investment horizon, which

further enhances returns. Moreover, as discussed in Chapter 1, larger companies

tend to benefit from their scale, market share, purchasing power, and lower risk

profile, and are often rewarded with a premium valuation relative to smaller peers,

all else being equal. In some cases, the sponsor opts not to maximize the amount

of debt financing at purchase. This provides greater flexibility to pursue a growth

strategy that may require future incremental debt to make acquisitions or build new

facilities, for example.

Efficiency Enhancement Opportunities

While an ideal LBO candidate should have a strong fundamental business model,

sponsors seek opportunities to improve operational efficiencies and generate cost sav-

ings. Traditional cost-saving measures include lowering corporate overhead, stream-

lining operations, reducing headcount, rationalizing the supply chain, and imple-

menting new management information systems. The sponsor may also seek to source

new (or negotiate better) terms with existing suppliers and customers. These initia-

tives are a primary focus for the consultants and industry experts hired by the sponsor

to assist with due diligence and assess the opportunity represented by establishing

“best practices” at the target. Their successful implementation often represents sub-

stantial value creation that accrues to equity value at a multiple of each dollar saved

(given an eventual exit).

At the same time, sponsors must be careful not to jeopardize existing sales or

attractive growth opportunities. Extensive cuts in marketing, capex, or research &

development, for example, may hurt customer retention, new product development,

or other growth initiatives. Such moves could put the company at risk of deteriorating

sales and profitability.

Low Capex Requirements

All else being equal, low capex requirements enhance a company’s cash flow gener-

ation capabilities. As a result, the best LBO candidates tend to have limited capital

investment needs. However, a company with substantial capex requirements may

still represent an attractive investment opportunity if it has a strong growth profile,

high profit margins, and the business strategy is validated during due diligence.

During due diligence, the sponsor and its advisors focus on differentiating those

expenditures deemed necessary to continue operating the business (“maintenance

capex”) from those that are discretionary (“growth capex”). Maintenance capex is

capital required to sustain existing assets (typically PP&E) at their current output

25

Selling the target for a higher multiple of EBITDA upon exit (i.e., purchasing the target for

7.0x EBITDA and selling it for 8.0x EBITDA).

P1: ABC/ABC P2:c/d QC:e/f T1:g

c04 JWBT063-Rosenbaum March 26, 2009 21:47 Printer Name: Hamilton

Leveraged Buyouts

171

levels. Growth capex is primarily used to purchase new assets or expand the existing

asset base. Therefore, growth capex can potentially be reduced or eliminated in the

event that economic conditions or operating performance decline.

Strong Asset Base

A strong asset base pledged as collateral against a loan benefits lenders by increasing

the likelihood of principal recovery in the event of bankruptcy (and liquidation). This,

in turn, increases their willingness to provide debt to the target. The target’s asset base

is particularly important in the leveraged loan market, where the value of the assets

helps dictate the amount of bank debt available (see “LBO Financing” sections for

additional information). A strong asset base also tends to signify high barriers to entry

because of the substantial capital investment required, which serves to deter new

entrants in the target’s markets. At the same time, a company with little or no assets

can still be an attractive LBO candidate provided it generates sufficient cash flow.

Proven Management Team

A proven management team serves to increase the attractiveness (and value) of an

LBO candidate. Talented management is critical in an LBO scenario given the need

to operate under a highly leveraged capital structure with ambitious performance

targets. Prior experience operating under such conditions, as well as success in inte-

grating acquisitions or implementing restructuring initiatives, is highly regarded by

sponsors.

For LBO candidates with strong management, the sponsor usually seeks to keep

the existing team in place post-acquisition. It is customary for management to retain,

invest, or be granted a meaningful equity stake so as to align their incentives under the

new ownership structure with that of the sponsor. Alternatively, in those instances

where the target’s management is weak, sponsors seek to add value by making key

changes to the existing team or installing a new team altogether to run the company.

In either circumstance, a strong management team is crucial for driving company

performance going forward and helping the sponsor meet its investment objectives.

ECONOMICS OF LBOs

Returns Analysis – Internal Rate of Return

Internal rate of return (IRR) is the primary metric by which sponsors gauge the

attractiveness of a potential LBO, as well as the performance of their existing invest-

ments. IRR measures the total return on a sponsor’s equity investment, including

any additional equity contributions made, or dividends received, during the invest-

ment horizon. It is defined as the discount rate that must be applied to the sponsor’s

cash outflows and inflows during the investment horizon in order to produce a net

present value (NPV) of zero. Although the IRR calculation can be performed with a

financial calculator or by using the IRR function in Microsoft Excel, it is important

to understand the supporting math. Exhibit 4.4 displays the equation for calculating

IRR, assuming a five-year investment horizon.

P1: ABC/ABC P2:c/d QC:e/f T1:g

c04 JWBT063-Rosenbaum March 26, 2009 21:47 Printer Name: Hamilton

172 LEVERAGED BUYOUTS

EXHIBIT 4.4 IRR Timeline

CF

1

(1+IRR)

CF

2

(1+IRR)

2

+

CF

3

(1+IRR)

3

+

CF

4

(1+IRR)

4

+

CF

5

(1+IRR)

5

+

+

=

CF

1

(1+IRR)

CF

2

(1+IRR)

2

+

CF

3

(1+IRR)

3

+

CF

4

(1+IRR)

4

+

CF

5

(1+IRR)

5

+

–CF

0

–CF

0

+

0

0.0=

(Equity

Contribution)

Year 0

Dividend/

(Investment)

Year 1

Dividend/

(Investment)

Year 2

Dividend/

(Investment)

Year 3

Dividend/

(Investment)

Year 4

Dividend/

(Investment)/

Equity Proceeds

Year 5

While multiple factors affect a sponsor’s ultimate decision to pursue a potential

acquisition, comfort with meeting acceptable IRR thresholds is critical. Sponsors

typically target superior returns relative to alternative investments for their LPs,

with a 20%+ threshold historically serving as a widely held “rule of thumb.” This

threshold, however, may increase or decrease depending on market conditions, the

perceived risk of an investment, and other factors specific to the situation.

The primary IRR drivers include the target’s projected financial performance,

26

purchase price, and financing structure (particularly the size of the equity contribu-

tion), as well as the exit multiple and year. As would be expected, a sponsor seeks

to minimize the price paid and equity contribution while gaining a strong degree of

confidence in the target’s future financial performance and the ability to exit at a

sufficient valuation.

In Exhibit 4.5, we assume that a sponsor contributes $250 million of equity (cash

outflow) at the end of Year 0 as part of the LBO financing structure and receives

equity proceeds upon sale of $750 million (cash inflow) at the end of Year 5. This

scenario produces an IRR of 24.6%, as demonstrated by the NPV of zero.

EXHIBIT 4.5

IRR Timeline Example

0.0

(1+.246)

0.0

(1+.246)

2

+

0.0

(1+.246)

3

+

0.0

(1+.246)

4

+

$750.0

(1+.246)

5

+

($250.0) +

0.0

=

(Equity

Contribution)

Year 0

Dividend/

(Investment)

Year 1

Dividend/

(Investment)

Year 2

Dividend/

(Investment)

Year 3

Dividend/

(Investment)

Year 4

Dividend/

(Investment)/

Equity Proceeds

Year 5

Returns Analysis – Cash Return

In addition to IRR, sponsors also examine returns on the basis of a multiple of their

cash investment (“cash return”). For example, assuming a sponsor contributes $250

million of equity and receives equity proceeds of $750 million at the end of the

investment horizon, the cash return is 3.0x (assuming no additional investments or

dividends during the period). However, unlike IRR, the cash return approach does

not factor in the time value of money.

26

Based on the sponsor’s model. See Chapter 5: LBO Analysis for additional information.

P1: ABC/ABC P2:c/d QC:e/f T1:g

c04 JWBT063-Rosenbaum March 26, 2009 21:47 Printer Name: Hamilton

Leveraged Buyouts

173

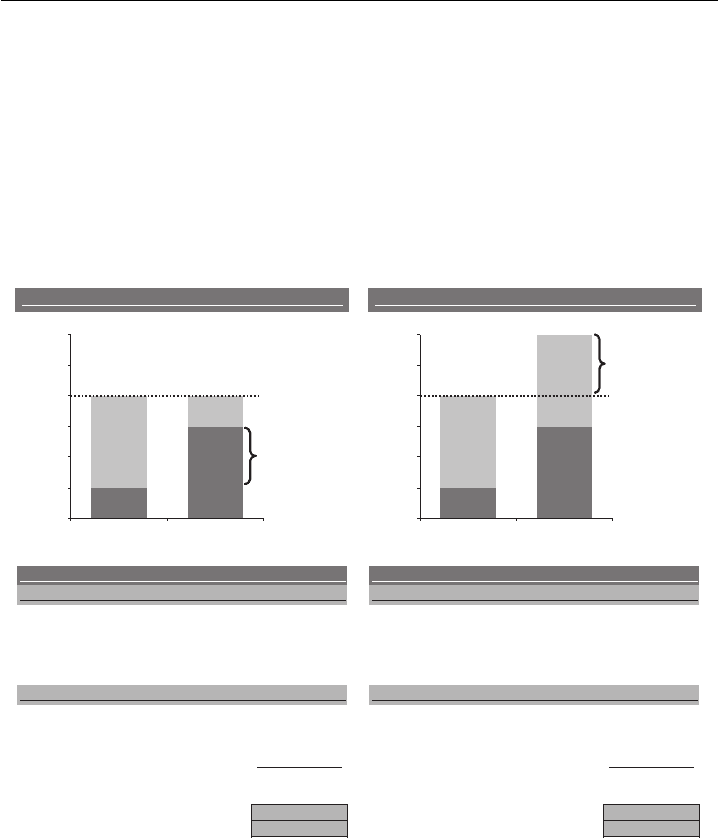

How LBOs Generate Returns

LBOs generate returns through a combination of debt repayment and growth in

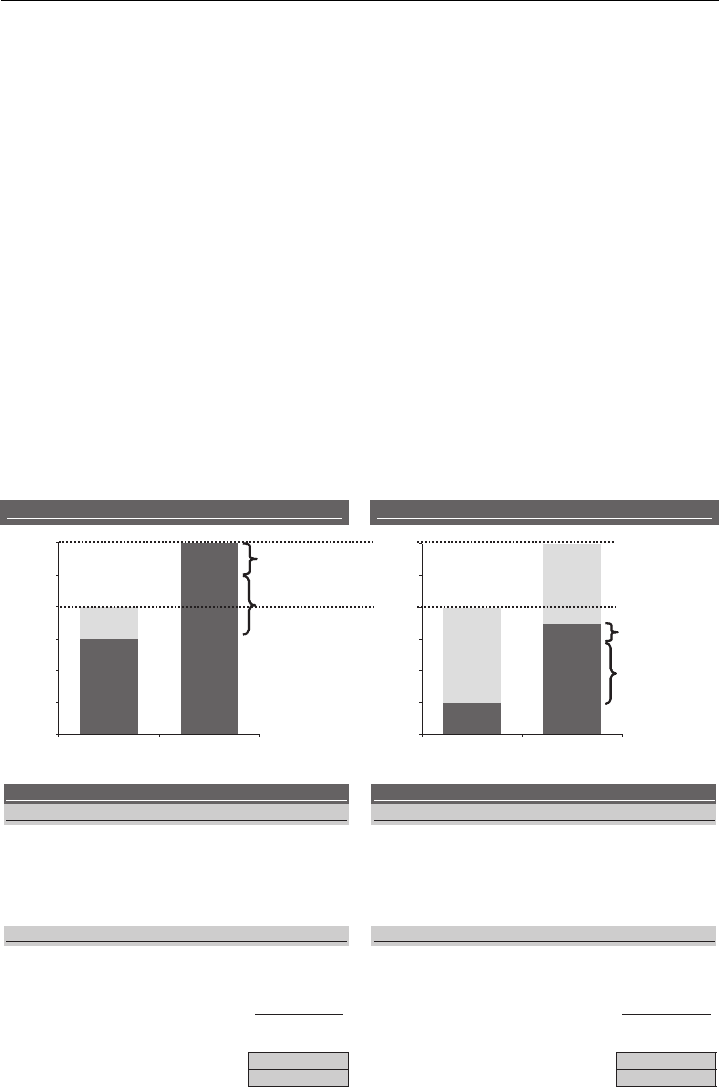

enterprise value. Exhibit 4.6 depicts how each of these scenarios independently

increases equity value, assuming a sponsor purchases a company for $1,000 million,

using $750 million of debt financing (75% of the purchase price) and an equity

contribution of $250 million (25% of the purchase price). In each scenario, the

returns are equivalent on both an IRR and cash return basis.

EXHIBIT 4.6

How LBOs Generate Returns

($ in millions)

Scenario I: Debt Repayment Scenario II: Enterprise Value Growth

Equity

$250

Debt

$750

Debt

$750

Equity

$750

$0

$250

$500

$750

$1,000

$1,250

$1,500

At Purchase

Year 0

Equity

$250

Debt

$750

Debt

$250

Equity

$750

$0

$250

$500

$750

$1,000

$1,250

$1,500

At Purchase

Year 0

$1,500 million

Sale Price

$500 million

Enterprise Value

Growth

$1,000 million

Purchase Price

$1,000 million

Purchase Price

& Sale Price

$500 million

Debt Repayment

At Exit

Year 5

At Exit

Year 5

Debt Repayment with No Enterprise Value Growth Enterprise Value Growth with No Debt Repayment

0.000,1$PricePurchase 0.000,1$ecirPesahcruP

0.052ContributionEquity 0.052noitubirtnoCytiuqE

0.005RepaymentDebt -tnemyapeRtbeD

0.000,1$5)(YearPriceSale 0.005,1$)5raeY(ecirPelaS

0.052$noitubirtnoCytiuqE 0.052$noitubirtnoCytiuqE

:eulaVytiuqEotsesaercnI:eulaVytiuqEotsesaercnI

-eulaVesirpretnEniesaercnI 0.005eulaVesirpretnEniesaercnI

Decrease in Debt from Repayment 500.0

Decrease in Debt from Repayment -

0.057$tixEtAeulaVytiuqE 0.057$tixEtAeulaVytiuqE

%6.42RRI%6.42RRI

x0.3nruteRhsaCx0.3nruteRhsaC

Assumptions

Assumptions

Equity Value Calculation and Returns Equity Value Calculation and Returns

Scenario I In Scenario I, we assume that the target generates cumulative free cash

flow of $500 million, which is used to repay debt during the investment horizon.

Debt repayment increases equity value on a dollar-for-dollar basis. Assuming the

sponsor sells the target for $1,000 million at exit, the value of the sponsor’s equity

investment increases from $250 million at purchase to $750 million even though

there is no growth in the company’s enterprise value. This scenario produces an IRR

of 24.6% (assuming a five-year investment horizon) with a cash return of 3.0x.

Scenario II In Scenario II, we assume that the target does not repay any debt during

the investment horizon. Rather, all cash generated by the target (after the payment

of interest expense) is reinvested into the business and the sponsor realizes 50%

growth in enterprise value by selling the target for $1,500 million after five years.

This enterprise value growth can be achieved through EBITDA growth (e.g., organic

P1: ABC/ABC P2:c/d QC:e/f T1:g

c04 JWBT063-Rosenbaum March 26, 2009 21:47 Printer Name: Hamilton

174 LEVERAGED BUYOUTS

growth, acquisitions, or streamlining operations) and/or achieving EBITDA multiple

expansion.

As the debt represents a fixed claim on the business, the incremental $500 million

of enterprise value accrues entirely to equity value. As in Scenario I, the value of the

sponsor’s equity investment increases from $250 million to $750 million, but this

time without any debt repayment. Consequently, Scenario II produces an IRR and

cash return equivalent to those in Scenario I (i.e., 24.6% and 3.0x, respectively).

How Leverage is Used to Enhance Returns

The concept of using leverage to enhance returns is fundamental to understanding

LBOs. Assuming a fixed enterprise value at exit, using a higher percentage of debt in

the financing structure (and a correspondingly smaller equity contribution) generates

higher returns. Exhibit 4.7 illustrates this principle by analyzing comparative returns

of an LBO financed with 25% debt versus an LBO financed with 75% debt. A higher

level of debt provides the additional benefit of greater tax savings realized due to the

tax deductibility of a higher amount of interest expense.

EXHIBIT 4.7

How Leverage is Used to Enhance Returns

($ in millions)

Scenario III: LBO Financed with 25% Debt Scenario IV: LBO Financed with 75% Debt

Eq uit y

$250

Debt

$750

Debt

$632

Equity

$868

$0

$250

$500

$750

$1,000

$1,250

$1,500

At Purchase

Year 0

Equity

$750

Debt

$250

Equity

$1,500

Debt

$0

$0

$250

$500

$750

$1,000

$1,250

$1,500

At Purchase

Year 0

$250 million

Debt Repayment

$500 million

Enterprise Value

Growth

$1,500 million

Sale Price

$1,0000 million

Purchase Price

$118 million

Debt Repayment

$500 million

Enterprise Value

Growth

75% Equity Contribution / 25% Debt 25% Equity Contribution / 75% Debt

0.000,1$ecirP esahcruP 0.000,1$ecirP esahcruP

Equity Contribution

750.0

Equity Contribution

250.0

%0.8tbeD fo tsoC%0.8tbeD fo tsoC

Cumulative FCF (after debt service) 250.0

Cumulative FCF (after debt service)

(b)

(a)

117.9

0.005,1$)5 raeY( ecirP elaS 0.005,1$)5 raeY( ecirP elaS

0.057$noitubirtnoC ytiuqE 0.052$noitubirtnoC ytiuqE

:eulaV ytiuqE ot sesaercnI:eulaV ytiuqE ot sesaercnI

0.005eulaV esirpretnE ni esaercnI 0.005eulaV esirpretnE ni esaercnI

Decrease in Debt from Repayment 250.0

(a)

In practice, the higher leverage in Scenario IV would require a higher blended cost of debt by investors

versus Scenario III. For simplicity, we assume a constant cost of debt in this example.

(b)

Reduced FCF in Scenario IV versus Scenario III reflects the incremental interest expense associated

with the additional $500 million of debt, which results in less cash available for debt repayment.

Decrease in Debt from Repayment 117.9

Equity Value At Exit

$1,500.0

Equity Value At Exit

$867.9

%3.82RRI%9.41RRI

x5.3nruteR hsaCx0.2nruteR hsaC

Equity Value and Returns

Equity Value and Returns

AssumptionsAssumptions

At Exit

Year 5

At Exit

Year 5