Faith, C.М. Way of the Turtle: The Secret Methods that Turned Ordinary People into Legendary Traders

Подождите немного. Документ загружается.

this strategy while having a very high exposure to any sort of price

shock. For example, anyone writing options against the eurodollar

in 1987 might have been wiped out. The loss from that price shock

combined with the exposure incurred by writing the options could

have been enough to result in a single-day loss greater than the

value of the fund.

Prudent managers can contain these risks. Unfortunately, many

investors find out about these sorts of risks only after it is too late

and they have lost their entire investment. They are seduced by the

steady returns and multiyear track records of funds that have not

yet experienced a truly bad day.

The MAR Ratio

The MAR ratio is a measure that was devised by Managed

Accounts Reports, LLC, which reports on the performance of

hedge funds. The MAR ratio divides the annual return by the

largest drawdown, using month-end figures. This ratio serves as a

quick and dirty direct measure of risk/reward that I find very useful

for filtering out poorly performing strategies. It is very good for a

rough cut. The Donchian Trend system had a MAR ratio of 1.22

over the period tested above from January 1996 to June 2006, where

the CAGR% was 27.38 percent and the maximum drawdown using

month-end figures was 22.35 percent.

I find the use of month-end figures to be a bit arbitrary and have

discovered that it often understates the true drawdown figures; so,

in my personal testing I use the maximum drawdown from the peak

day to the trough day without regard to where those days fall dur-

ing the month. To give you some idea of how this might differ from

a measure that uses only month-end data, the actual maximum

104 • Way of the Turtle

drawdown, including days other than the end of a month, was 27.58

percent rather than 22.35 percent using only month-end figures.

The resulting MAR ratio is 0.99 rather than the original 1.22 using

only month-end figures.

System Death Risk Revisited

One of the most interesting observations I have made about trad-

ing systems, strategies, and performance is that those strategies

which historically appear to offer extremely good risk/reward ratios

tend to be the ones that are the most heavily imitated by the

broader trading community. Soon you end up with billions of dol-

lars in trades chasing that strategy, and as a result, those strategies

can implode as they outgrow the liquidity of the markets in which

they are traded. They end up suffering from early system death.

Arbitrage strategies are perhaps the best example of this. An arbi-

trage in its purest form is an essentially risk-free trade. You buy

something in one place, sell it at another place, subtract the cost

of transportation or storage and pocket the difference. Most arbi-

trage strategies are not quite that risk-free, but many come close.

The problem is that these strategies make money only when there

is a spread between the prices at different locations or between the

price of one instrument and that of a similar instrument.

The more traders implement a particular strategy, the more the

spread will drop as those traders start to compete for essentially the

same trades. This effect kills off the strategy over time as it becomes

less and less profitable.

Conversely, systems and strategies that do not appeal to the typ-

ical investor tend to have much longer lifetimes. Trend following

By What Measure? • 105

is a good example. Most large investors are uncomfortable with the

large drawdowns and equity fluctuations that are common to trend-

following strategies. For this reason, trend following continues to

work over a long period of time.

Returns tend to be cyclical however. Every time there is a huge

new influx of capital after a period of relatively sedate returns, there

is generally a period of a few relatively tough years since the mar-

ket cannot easily digest the amount of new money from investors

who are using the same strategies in the same markets. This is gen-

erally followed by a period of good returns as investors withdraw

their money from trend following funds after periods of relatively

poor performance.

Be careful what you look for: If you get too greedy when exam-

ining a strategy, you are going to increase the chances that you will

not get the results you seek. Strategies that seem to be the best in

retrospect are also those most likely to attract new investors and as

a consequence often start performing poorly soon after the new

investments take place.

Everybody’s Different

Each of us has a different tolerance for pain and different expecta-

tions for reward. For this reason, there is no single measure that

universally appeals to everyone. I have used a combination of the

MAR ratio, drawdowns, and overall return while keeping an eye on

smoothness by looking at the Sharpe ratio and R-squared figures.

Recently I designed some measures that are more stable versions

of these common measures. Those measures are discussed in

Chapter 12.

106 • Way of the Turtle

I also try not to get too caught up in any particular figures, know-

ing that the future will be different and that the fact that a strategy

has a MAR of 1.5 at the moment does not mean it will continue to

maintain that ratio in the future.

By What Measure? • 107

This page intentionally left blank

•109•

eight

RISK AND MONEY

MANAGEMENT

Ruin is the risk you should be concerned with the most.

It can come like a thief in the night and steal everything

if you aren’t watching carefully.

L

ike many of the concepts we use in trading, expectation, edge,

risk of ruin and so on, the term money managementcomes

from gambling theory. Money management is the art of keeping

your risk of ruin at an acceptable level while maximizing your

profit potential by choosing an appropriate number of shares or

contracts to trade, something we refer to as the sizeof the trade,

and by limiting the aggregate size of the position to control expo-

sure to price shocks. Good money management helps ensure that

you will continue to be able to trade through the inevitable bad

periods that every trader experiences. Most discussions of the topic

make use of countless formulas and cover different methods for

determining precisely the number of contracts one should trade.

They approach risk as if it were a definable and knowable concept,

but it isn’t. This chapter won’t duplicate those discussions. If you

Copyright © 2007 by Curtis M. Faith. Click here for terms of use.

want a survey of the many different methods you can use to deter-

mine the number of contracts to trade, several books listed in the

bibliography cover that topic.

I believe that money management is more art than science, or

perhaps more like religion than art. There are no right answers.

There are no best ways to define one’s risk position. There are only

individual answers that work for each person; those answers can be

obtained only by asking the right questions.

At its core, money management is about finding the trade-off

between taking so much risk that you end up losing everything or

are forced to quit trading and, conversely, taking so little risk that

you end up leaving too much money on the table. There are two

primary ways that excessive risk can force you to stop trading:

extended drawdowns that exceed your psychological limits and a

sudden price shock that wipes out the account.

Your proper level of risk is very much a function of what is impor-

tant to you. For that reason, if you want to trade, you have to become

intimately familiar with the implications of taking too much risk or

too little risk so that you can make an informed decision.

Many vendors of systems or courses on trading make it seem that

anyone can follow their methods and achieve riches quickly and

easily. They do this because it helps them sell more systems and

more courses on trading. They understate the dangers of risk and

overstate the probabilities and ease of attaining those riches.

They are lying. The risk is real, and trading is not easy.

It is very important to keep one thing in mind before deciding

to be aggressive: Steady returns of 20 or 30 percent per year will

make you a lot of money in a reasonably short period starting with

almost any amount of money. The power of compounding is very

110 • Way of the Turtle

strong, but only if you don’t lose everything and have to start over

again. If you begin with $50,000, you will have almost $10 million

after 20 years—if you can earn 30 percent returns.

Trying to go for very aggressive returns of 100 percent or 200 per-

cent per year greatly increases the chances that you will blow up

and have to stop trading. I highly recommend taking a conserva-

tive approach for the first several years of trading.

Consider what would have happened if you had been trading

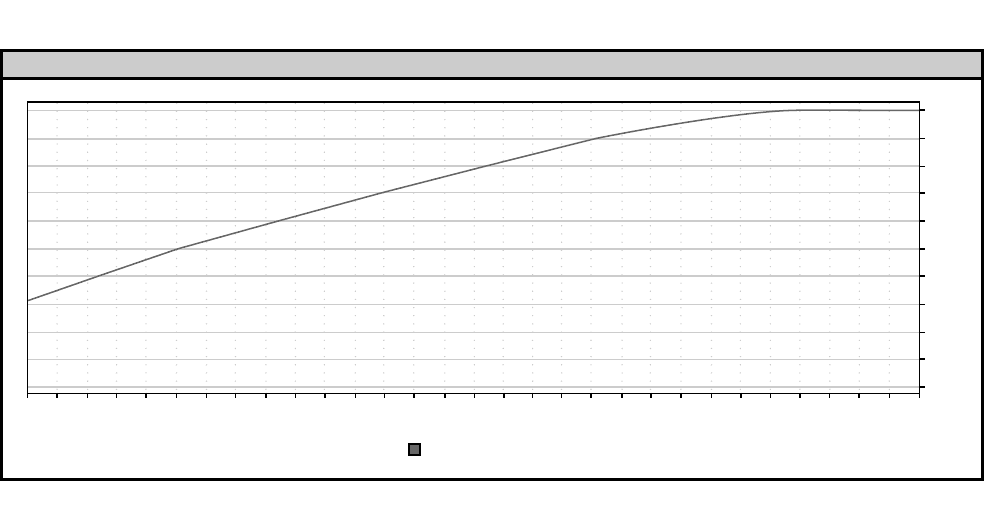

with the Donchian Trend system in 1987 at aggressive levels. Fig-

ure 8-1 shows the drawdowns that are encountered as the risk lev-

els increase.

Note how the graph rises steadily and levels off at the 100 per-

cent point. This means that if you were trading aggressively and

risking 3 percent of your trading capital on each trade, you

would have gone bust overnight because this drawdown is due

entirely to that single day when the interest-rate markets

reversed precipitously.

For most people, a prudent way to trade would be at a level that

demonstrates a drawdown, using historical simulations, that is at

most one-half the level you believe you can tolerate. This will pro-

vide a buffer in case the system has a drawdown that is larger than

what previously had been seen during testing. It also will make it

less likely that an unexpected price shock will cause you to lose all

your trading capital.

Don’t Believe Everything You Hear

Many people have touted money management as a magical elixir

that can cure all that ails your trading. Others have devised com-

Risk and Money Management • 111

Max Drawdown as Risk Per Trade (%) Varies

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

4.0%

3.

9%

3.8%

3.7

%

3.6%

3.

5%

3.

4%

3.3%

3.2%

3.1%

3.0%

2.9%

2.8%

2.7%

2.6%

2.5%

2.4%

2.3%

2.2%

2.1%

2.0%

1.9%

1.8%

1.7%

1.6%

1.5%

1.4%

1.3%

1.2%

1.1%

1.0%

Risk Per Trade (%)

Figure 8-1 Drawdown versus Risk

Copyright 2006 Trading Blox, LLC. All rights reserved worldwide.

• 112 •

plex formulas and written entire books about money management.

It shouldn’t be that complicated.

Proper money management is quite simple. For a trading

account of a particular size, you can safely buy a certain number

of contracts in each futures market. For some markets and for

smaller accounts this amount may be zero.

For example, the natural gas (NYMEX symbol NG) contract ear-

lier this year had an ATR that represented more than $7,500 per con-

tract. Remember, this means that the value of the contract fluctuated

$7,500 on the average each day. Thus, for a system that used a 2-ATR

stop such as the Donchian Trend system, a single trade could mean

a loss of $15,000. If you were trading an account as large as $50,000,

this would represent 30 percent of the account. Most people would

say that risking 30 percent of your trading account on one trade is a

really bad idea. Therefore, a prudent number of contracts of NG to

trade would be zero for an account of $50,000. Even for an account

as large as $1 million, such a trade would represent a 1.5 percent risk

level, which many would consider fairly aggressive.

Trading with too much risk is probably the single most common

reason for failure among new traders. Often novices trade so aggres-

sively that a small string of losses will wipe out their trading capital.

New traders often misunderstand the dangers of leverage, and

because their broker and the exchange permits them to buy and sell

large contracts with as little as $20,000, they often do precisely that.

Risk of Ruin Revisited

Earlier we discussed the concept of risk of ruin: The possibility of

losing so much capital as a result of a string of losses that one is

Risk and Money Management • 113